ITR filing deadline: There is a demand to extend the last date for filing income tax returns to 31 August. In such a situation, it is expected that relief can be given in the 2025 budget. At present, the return has to be filed by 31 July.

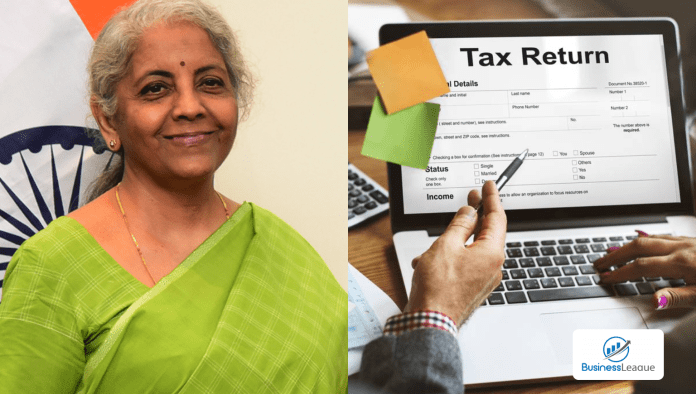

ITR filing deadline: Finance Minister Nirmala Sitharaman is going to present the budget on 1 February. She will present her eighth budget. This time there is a preparation to give relief to taxpayers through the budget. Actually, there is a demand to extend the last date for filing income tax returns to 31 August. In such a situation, it is expected that relief can be given in the 2025 budget. The government can extend the last date for filing income tax returns. Tax payers have been demanding for a long time that enough time should be given to file Income Tax Returns (ITR) after the financial year. Currently the last date for filing income tax returns is 31 July. It starts from the first day of the next financial year.

What is the whole math?

At present, the return has to be filed by 31 July. For this, they have to get their Form 16 by 15 June. In this way, the taxpayer gets only 45 days. Now some people will say that 45 days are enough. No, it takes a lot of time to collect the necessary documents. This is the reason why taxpayers want an increase in its date. In such a situation, it will be interesting to see whether there will be a change in it or not.

A hefty fine has to be paid in case of delay

If a taxpayer files his income tax return after the date of 31 July. In such a situation, he has to pay a fine. If you file income tax return by 30 December, then you have to pay a fine of 1 thousand. On the other hand, if you file after 30 December, then you have to pay a fine of up to 5 thousand.

What are the demands?

The date for filing income tax return should be extended from 31 July to 31 August. This will give sufficient time to the taxpayers. In addition, extending the last date for filing belated returns to March 31 will give taxpayers an opportunity to properly enter information about foreign income and tax credits. This will help them avoid fines and interest.

Most Read Articles:

- Income Taxpayers Alert: Check this income tax paper quarterly, otherwise there will be trouble while filing ITR

- Indian Passport Holders: Good news! Visit these four countries to boost your passport power, know details

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide