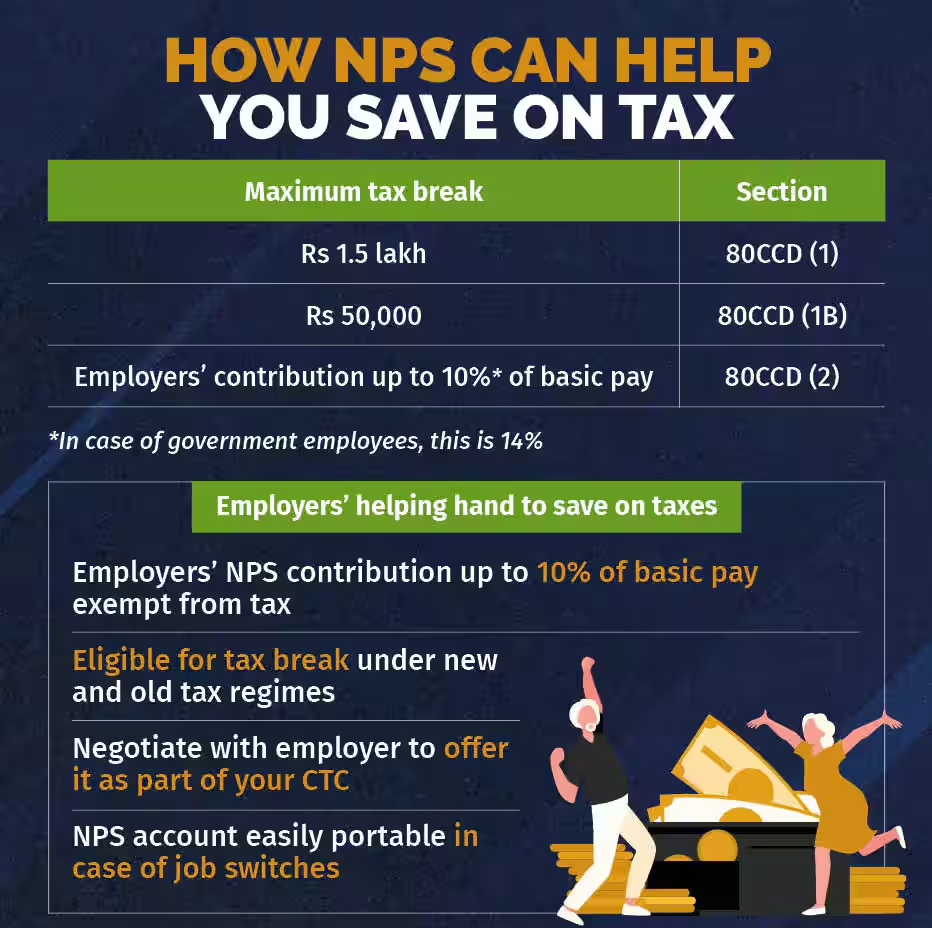

ITR Filing: A person between 18 and 70 years of age can contribute to NPS. This provides regular income for post-retirement expenses. The tax benefit on contribution to NPS is its biggest attraction.

ITR Filing: The deadline for income tax return filing is near. You should start preparing for ITR filing 2024 from now. Moneycontrol is telling you about the tax exemption available in NPS. It is a good option to get regular income after retirement. Also, there is a lot of tax exemption on contribution in it. First, under section 80C of the Income Tax Act, tax deduction can be claimed on contribution up to Rs 1.5 lakh annually. Apart from this, an additional deduction of Rs 50,000 is also available under section 80CCD (1B). You have to keep this tax exemption in mind while filing ITR.

Tax benefit on employer’s contribution

An employee can request his employer to contribute to NPS (National Pension System). For this, his cost-to-company (CTC) will have to be changed. This will enable the employee to claim deduction of up to 10% of the basic salary (plus dearness allowance) under section 80CCD (2). If you are already using this option, it will be visible in your Form-16.

This benefit is also available in the new regime

The benefit of tax exemption on contribution to NPS is also available in the new regime of income tax. Deduction can be claimed on employer’s contribution of up to 10% of the basic salary (plus dearness allowance). For government employees, it is 14%.

Section 80CCD(1) is only for employed people

If you are employed, you can claim deduction by contributing up to 10% of your basic salary (plus dearness allowance) to NPS under section 80CCD(1). Even if you are not employed, you can contribute to NPS. But your contribution will be under section 80C. It will not exceed Rs 1.5 lakh annually. Apart from this, you can claim deduction of additional Rs 50,000 under section 80CCD(1B).

How to avail 80CCD(1)

NPS subscribers are aware of the deductions mentioned above. But, very few employees avail the tax exemption under the corporate tax scheme. Section 80CCD(2) can help you a lot in reducing your tax liability. But, for this your employer will also have to contribute to your NPS corpus. This benefit is available in both the old and new income tax regimes. If you are not currently availing this tax exemption and you are an NPS subscriber, then you can request your employer for this facility. For this, you will have to share your Permanent Account Number (PRAN) with the employer.

You can avail tax exemption on NPS in three ways

In this way, if you are employed, you can avail tax exemption on NPS in three ways. First, under section 80C, you can claim deduction on contribution of up to Rs 1.5 lakh annually in NPS. Second, under section 80CCD (1B), you can claim deduction on additional Rs 50,000. Third, employer’s contribution of up to 10% of basic pay (plus DA) can be claimed as tax-exempt under section 80CCD(2). This employer’s contribution is not taxable.

Also Read-

- ICICI Bank has increased the interest on FD! Check the interest rate

- Three new criminal laws come into force from today, know what will be the impact on the justice system and citizens

- IBPS Clerk Notification 2024: Notification issued for recruitment of 6,000 clerk posts in national banks, application starts today