Changes in the rules of ITR filling, if you are more than 75 years of age, then you must read the new rules of ITR once, according to the new rules of ITR, the elderly people above the age of 75 years will not have to fill the ITR file.

A new section 194P has been inserted in the Income Tax Act 1961. Those senior citizens whose age is more than 75 years and the money kept in their bank account is only for pension and interest, then such citizens will now be exempted from filing ITR. Meaning that such senior citizens whose only source of income is pension or interest from the money kept in the bank, then such senior citizens are no longer required to file Income Tax Return. Now Senior Citizens above the age of 75 years will be given exemption in ITR under new section 194P in Income Tax Act 1961 under Finance Act 2021.

Income Tax Department has shared this information on Twitter

It has been informed by the Income Tax Department from the official Twitter handle that the new section 194P inserted in the Income Tax Act 1961 provides that only pension kept in the bank account of Senior Citizens above the age of 75 years. and have interest money, then in this circumstance they will be completely exempted from filing ITR.

According to Investment Advisor Jitendra Solanki, due to the inclusion of a new section 194P in the Income Tax Act 1961, now people above the age of 75 years, whose means of earning is only interest money, then such people will now have to pay ITR. No need to enter. Because such people will get relief from this new stream. Let us tell you that Senior Citizens will not get any kind of financial help from this new stream.

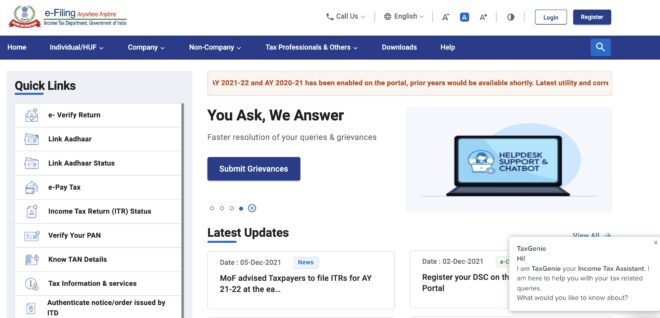

How to submit ITR online

- Any person can file ITR through online mode. To file ITR, you have to go to the e-filing portal of Income Tax .

- On this portal, you have to click on Login Option and then continue by entering your User Name and Password.

- Now you have to click on the e-file option.

- Then you will see the option of File Income Tax Return. You have to click on this option.

- Now you have to select the option of Assessment Year 2021-22 and click on Continue option.

- Now two options will come in front of you, Online and Offline. You have to click on Online Option. After this you have to choose the option of the next Individual.

- Now you have to select the option of ITR – 1 or ITR – 4 and click on the option of Proceed.

- Now in the next step, you will be asked the reason for filing your return due to the 7th provision under section 139(1).

- You have to choose the right option while filing ITR online in this.

- Now you have to fill your bank details here and then a new page to file ITR will open in front of you.

- Now you have to send OTP to your Aadhaar card link phone number to verify ITR here.

- Then you will be able to file ITR easily.