While processing ITR, the department on a prima facie basis checks your income details, TDS claimed by you and if that matches with Form 26AS and so on.

While processing ITR, the department on a prima facie basis, checks your income details, TDS claimed by you and if that matches with Form 26AS and so on.

As per current income tax laws, the time limit to process ITRs by the tax department is within one year from the end of the financial year in which ITR was filed. Thus, your ITR must be processed by March 31, 2021 for the return filed for FY 2018-19.

Once your ITR is processed, the income tax department sends you an intimation notice.

However, it may happen that you have received an SMS from the income tax department stating: “ITR for PAN: AAAXXXXX0A, AY 2019-20 and Ack No. XXXXXXXXXXXXXXX has been processed at CPC. Order u/s 143(1) will be sent by email.” But you cannot find the email from the tax department in your inbox.

Remember, this email will be sent to the email ID registered in the tax department’s records.

Follow the steps below to get the intimation notice sent to you once again.

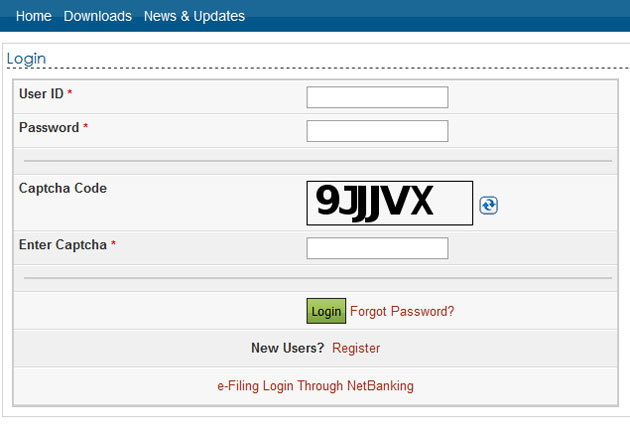

Step 1: Visit www.incometaxindiaefiling.gov.in

Step 2: Log in to your account. The user ID is your PAN number.

Step 6: A new webpage will open on your screen. You will be required to enter the following information:

a) Return Type: Income Tax Return

b) Assessment year

c) Category: Intimation u/s 143 (1)

The sub-category will be selected automatically.

An email will be sent to your registered email ID with your transaction ID. Usually, the income tax department replies to your request within two to three days.