ITR Refund: Those who have filed ITR on time are now waiting for their refund. The e-filing process of income tax return has become much faster than before, so now ITR refund usually comes in around a month. If you are also waiting for your refund, then before that understand the 3 rules of the Income Tax Department well.

Who gets ITR refund?

Not every person who files ITR gets a refund. Taxpayers who have paid more tax in the previous financial year claim for ITR refund. This includes tax deducted at source (TDS), tax collected at source (TCS), as well as advance tax and self-assessment tax paid by the taxpayer. After filing ITR, the Income Tax Department checks your form and then processes your refund. This refund comes directly to the bank account linked to your PAN.

If you are unable to file ITR by 31st July, will you get a refund?

If you are unable to file your ITR by the ITR Filing deadline, you can still claim your refund for up to six assessment years, as per Circular No. 9/2015, provided you fulfill certain conditions. To claim a refund under this circular, you will first have to apply for a waiver of delay. Once approved, you can file your ITR online for the last six years.

Refund can be adjusted in previous dues

If you have any tax due in previous years, then under the Income Tax laws, the department has the right to compensate it from your refund. However, before doing so, the Income Tax Department should inform the taxpayers. If this is not done or you feel that your refund has been adjusted wrongly, you can log in to your account and lodge a complaint on the Income Tax website.

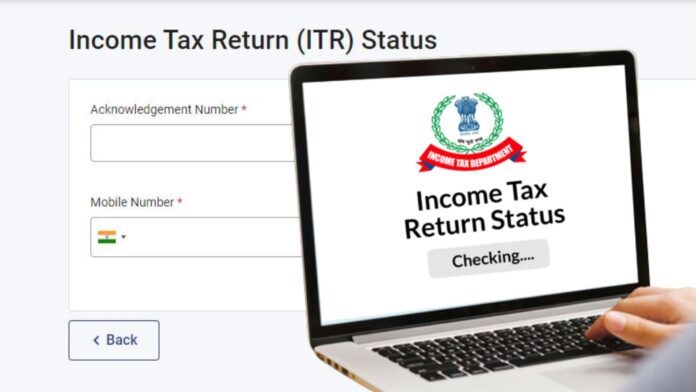

Check the status of your refund like this

First of all, go to the e-filing portal of Income Tax. After logging in, go to the e-File tab and click on View Filed Returns under Income Tax Returns. By clicking on View Details, you can see the refund status as well as the life cycle of ITR.