The Reserve Bank of India has barred banks from opening current accounts for customers who have availed cash loans or overdrafts. Rbi asserted that discipline is needed in this matter.

Mumbai: The Reserve Bank of India on Thursday (August 6) barred banks from opening current accounts for customers who have availed cash loans or overdrafts. Rbi asserted that discipline is needed in this matter. In a notification, the central bank (RBI) said that as compared to opening a new current account, all transactions should be done through cash loan or overdraft (OD) account.

However, the RBI did not say what was the reason behind the move. It is noteworthy that several accounts were found to have been opened in the PMC Co-operative Bank scam case over Rs 4,000 crore. Officials say it will curb the cheating of the system. This will ultimately protect depositors’ money.

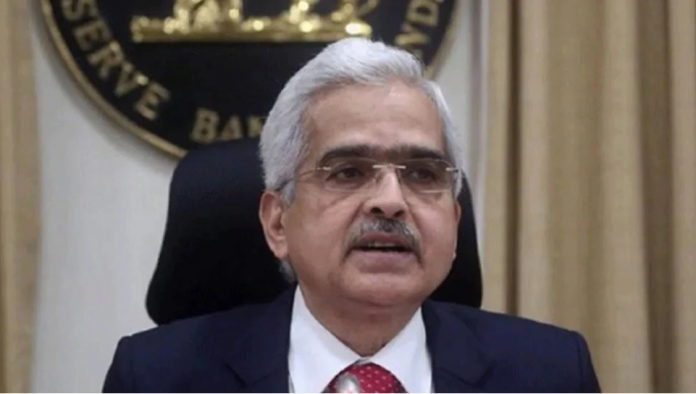

“It is important to take appropriate steps for debt discipline,” RBI Governor Shaktikanta Das said on Thursday, adding that there are concerns about the use of multiple accounts by borrowers. In view of this, precautionary measures need to be taken by borrowers availing loans from several banks to open such accounts.

According to RBI, banks need to be disciplined in opening current accounts. No bank will open the current accounts of customers who have cash loans (CC) from banks/banks. The loan facility is taken in the form of overdraft. All transactions of these clients are cc/s. OD can be done through the account.