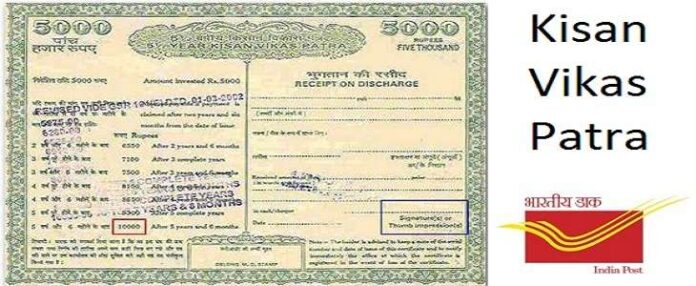

Kisan Vikas Patra: There are many investment options in the market. When it comes to investing without risk, the first attention goes to FD. Kisan Vikas Patra gives more interest than FD. Apart from this, many other facilities are also available in it. Let us know in this article what facilities are available in Kisan Vikas Patra.

Investment is also very important along with earning. There are many options in the market for investment. If we want, we invest in schemes with risk or without risk. Whenever it comes to investment options without risk, our first attention goes to FD (Fixed Deposit).

FD gives guaranteed returns. But, do you know that there is also a scheme in the market in which more interest is available than FD and other facilities are also available. Yes, we are talking about Kisan Vikas Patra (KVP) scheme. In this scheme, 7.5 percent interest is available.

These FDs offer higher interest (Kisan Vikas Patra vs Fixed Deposit)

Kisan Vikas Patra offers higher interest than FDs of many banks. Let us know about the FD interest rates of the main banks.

| Scheme | Interest |

| Kisan Vikas Patra (KVP) | 7.50% |

| Axis FD | 7.10% |

| State Bank of India FD (SBI FD) | 7.00% |

| HDFC Bank FD | 7.00% |

| Bank of India FD (BOI FD) | 6.75% |

| Union Bank FD | 6.50% |

These facilities are available in Kisan Vikas Patra

- Kisan Vikas Patra (KVP) is a Post Office Scheme. In this scheme, you can transfer your certificate to the name of another person. Apart from this, it can also be transferred from one post office to another.

- The minimum age for investing in Kisan Vikas Patra is 18 years. Apart from a single account, investment can also be made in a joint account in this scheme. Let us tell you that if a minor’s account is opened in it, then the parents are responsible for looking after it.

- The advantage of having a joint account is that two people can invest in it together. In such a situation, there is no burden of investing on one person.

- The lock-in period of Kisan Vikas Patra is 2.5 years (30 months). The investor cannot withdraw money from the account till the lock-in period.