According to RBI data, usage of debit cards, the second-most popular payment mode after currency notes, crashed 44% in terms of transactions and 55% by value, compared to March numbers.

This fall began in March when the lockdown was announced in the third week of the month. A sharp reduction in the usage of ATMs and point of sale (PoS) devices, popularly called card-swipe machines, was seen. The resultant job losses and the reverse migration of labour also reduced the usage of low-value payment modes, bankers said.

According to RBI data, usage of debit cards, the second-most popular payment mode after currency notes, crashed 44% in terms of transactions and 55% by value, compared to March numbers. The data also showed a 70% fall in use of credit card by volume and 60% by value. Digital wallet transactions were down 33% by value, while the fall in terms of numbers was 42%. This is the sharpest month-on-month slide observed in these three payments channels since demonetisation.

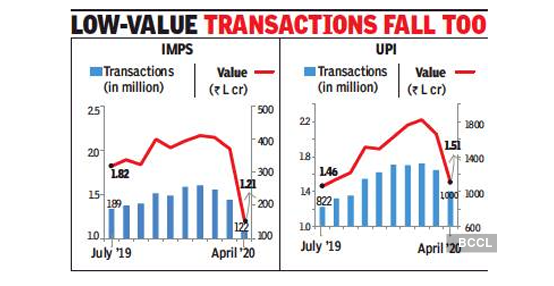

The use of RTGS, NEFT, IMPS and UPI also fell in April as the economic activity nearly stalled. RTGS payments, which are mainly used by large businesses, MSMEs and vendors for high-value transactions, nearly halved to Rs 64 lakh crore from Rs 120.5 lakh crore in the previous month. NEFT, used by both corporates and individuals to transfer funds, fell 43% month-on-month to Rs 13 lakh crore.

The value of transactions through IMPS, which is largely used by small businesses and migrant labours, fell 40% to Rs 1.21 lakh crore in April versus March. Bankers said IMPS volumes are a better indicator of payment patterns of the people at the bottom of the pyramid, since that is the cheapest form of fund transfer in India.