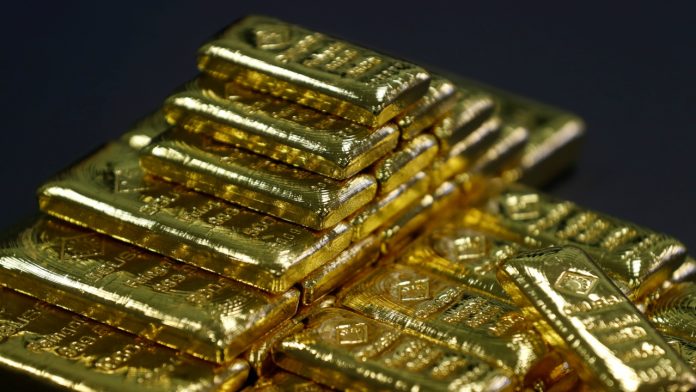

A precious metal that commands cultural and financial value, gold influences a range of national socio-cultural factors and local market conditions across the world.

Gold is a precious metal and it has a cultural and financial value. It is bought for different reasons by people across the globe. It influences a range of national socio-cultural factors and local market conditions. (Reuters)

In terms of volume, India and China make for the largest markets together accounting for over 50% of current global gold demand. The Asian and Middle Eastern markets are dominated by demand for purer, high-caratage gold. (Reuters)

Mines account for around 75% of overall gold supply and the remaining shortfall to meet demand is made up from recycled gold. (Reuters)

The most immediately responsive source of gold supply to the gold price and economic shocks is recycling. The majority of recycled gold – around 90% – comes from jewellery, with gold extracted from technology providing the remaining 10%. (Reuters)

Over 90 percent of the world’s gold has been mined since the California Gold Rush. (Reuters)

Around 187,200 tonnes of gold has been mined since the beginning of civilisation. (Reuters)

If all of the existing gold in the world was pulled into a 5 micron thick wire, it could wrap around the world 11.2 million times. (Reuters)

The US Federal Reserve holds 6,700 tonnes of gold, in 530,000 gold bars. At its peak in 1973, the Fed stored more than 12,000 tonnes of monetary gold. (Reuters)

Around half of all gold mined today is made into jewellery, which remains the single largest use for gold. (Reuters)