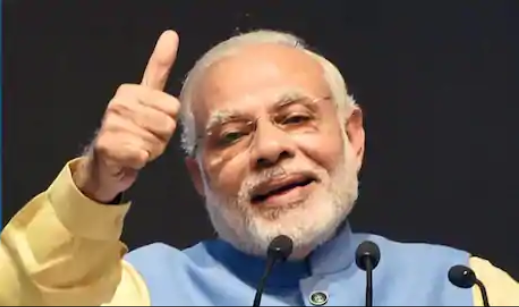

The Modi government has extended the last date for filing of ‘Vivad se Vishwas’ scheme, GST waiving scheme, late fee waiver scheme, GST Return Electronic Verification Code (EVC).

At the same time, the Income Tax Department extended the deadline for various compliances related to filing details for normalization fee (equalization levy) and remittance and availing GST waiver scheme. The government has taken this step to help the taxpayers to overcome the difficulties in filling up such forms with regard to filing of returns for normalization charges (equalization levy) and remittances.

The deadline for filing normalization fee details in Form-1 for the financial year 2020-21 has been extended up to December 31 from the original due date of June 30. Quarterly statements in Form 15CC to be submitted by authorized dealers in respect of remittances made for June and September quarters can now be filed by November 30 and December 31 respectively. The original due dates for filing this statement were July 15 and October 15, respectively.

In a statement, the Central Board of Direct Taxes (CBDT) said that it has been informed about the difficulties being faced by taxpayers and other stakeholders in electronic filing of certain forms. Keeping this in mind, it has been decided to extend the dates of e-submission of these forms.

Benefit of ‘Vivad se Vishwas’ scheme now till 31 October

In a separate statement, the CBDT announced extension of the deadline for making payments under the direct tax dispute resolution scheme ‘Vivad Se Vishwas’ (VSV) by one month till September 30. However, taxpayers will have the option to pay the additional interest amount by October 31. The government has taken this step to help the taxpayers in the time of Kovid-19 pandemic.

Benefits of GST waiver scheme till November 30

Apart from this, the last date for availing the benefits of GST waiver scheme has been extended by three months to 30 November. Under the scheme, taxpayers will have to pay a reduced fee for delay in filing monthly returns. At the same time, the last date for filing GST return Electronic Verification Code (EVC) has been extended to 31 October.

Deadline of late fee waiver scheme also extended

The GST Council, headed by Finance Minister Nirmala Sitharaman, in May decided to bring in a waiver scheme to provide late fee relief to taxpayers for pending returns. The finance ministers of all the states are members of the GST Council. Late fee for non-filing of GSTR-3B for July 2017 to April 2021 has been capped at Rs 500 per return for taxpayers who do not have any tax liability.

Whereas for those with tax liability, a maximum late fee of Rs 1,000 per return will be charged, provided such returns have been filed by August 31, 2021. “Last date for availing late fee waiver scheme,” the ministry said in a statement. Now extended from the existing 31st August, 2021 to 30th November, 2021.”