PMMY Loan Scheme: You can easily start your business under this central governments scheme known as Pradhan Mantri Mudra Yojana. Under PMMY scheme, the government give loans to people to start their own business. The interested ones can take a loan of up to Rs 10 lakh and within 7 – 10 days of your application, the loan amount is available.

This government scheme was started in 2015 and the government has released Rs 48145.27 crore till 14 August 2020 in the 2020-21 session. It can be noted that the full name of Pradhan Mantri Mudra Yojana (PMMY) is Micro Unit Development Refinance Agency.

Feature of the Governments Mudra scheme

The most interesting feature of the Mudra scheme is that under this, the government gives loans to the people without any guarantee and without any processing charge. In other words, government gives loans to people with no guarantee and also no processing charge is charged on them.

Also, person taking the loan can take 5 years more time to repay the loan amount. These things make PM Mudra Yojana different from other types of loans schemes.

What are the different types of loans available under Mudra Scheme?

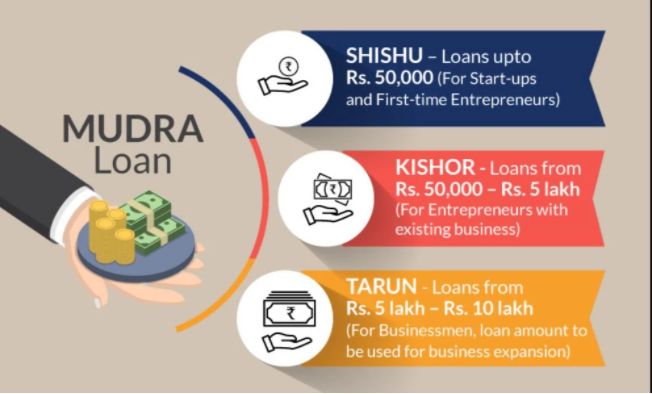

There are 3 types of loans available under Mudra Yojana-

1. Shishu Mudra Loan:

In this category, one can take a loan of up to 50,000 rupees to start their business.

2. Kishore Mudra Loan:

Under this, if you have a business but its not yet established and you want to stand it now, then you can take a loan of up to Rs 5 lakh.

3. Tarun Mudra Loan:

The maximum loan is available under this category of Mudra scheme. You can take a loan of up to Rs 10 lakh and increase your business.

Also Read: BIG NEWS🙄: No License, Registration Needed To Ride This New Electric Bike

What are the interest rates of Mudra loan scheme?

Please note- The figures for 2020-21 are till 14 August 2020.

Under the PMMY, there are different interest rates which are set in each category. It depends on the type of business of the person who is taking the loan. But, the minimum interest rate in this is 12 percent. Also, at the same time, if you are taking the loan under Tarun Mudra scheme, then you will have to pay interest up to 16%.

It is to be noted that this scheme is not for any corporate.

Small institutions and individuals can take advantage of this scheme to establish their business which includes proprietorship firms, service sector units, small manufacturing units, shopkeepers, partnership firms, repair shops, fruit and vegetable vendors, machine operators, truck / car drivers, small industries, hotel owners, rural and urban area industries and food processing.

Loan can also be taken for the unit.

However, the condition for this is that the monthly income of the borrower applicant must be over Rs 17,000. If the applicant is a businessman, then it is necessary for him that his business is at least 5 years old.

But, if a person is taking the loan to start a business, then it is necessary for him to have a job for the first 2 years.

If an enterprise is applying for mudra loan scheme, then its annual business is mandatory to be up to Rs 15 lakh.