Domestic mutual funds have invested over Rs 1.23 lakh crores in equities between December 2016 and January 2018. Most experts advise investors to use the mutual fund route while investing in equities as the mangers managing these funds use advanced techniques for stock selection. They use various quantitative and qualitative criteria for identifying fundamentally sound stocks. Looking at the constituents of the BSE500 index, there are 95 companies where mutual funds have consistently increased their stake between December 2016 quarter and December 2017 quarter. 77 companies have gained in price whereas 18 companies declined between 30 December 2016 and 20 February 2018. The average returns of these 95 companies were 36.9 per cent compared to BSE500 index that delivered 31.2 per cent returns. Let us look at the five favourite stocks of mutual funds that have delivered highest returns in the past 13 months:

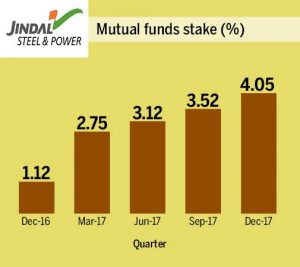

Jindal Steel and Power: A business conglomerate with significant presence in core infrastructure sectors including steel, power, mining and infrastructure. Its operates across Chhattisgarh, Odisha and Jharkhand. Mutual funds increased their stake in the company from 1.12 per cent in December 2016 to 4.05 per cent in December 2017 quarter. In Q3FY18, the company posted consolidated top line growth of 19 per cent and suffered a consolidated net loss of Rs -276.9 crores. The stock delivered a point to point return of 264.2 per cent and outperformed the market by 8.5 times between 30 December 2016 and 20 February 2018. BSE500 index delivered 31.2 per cent returns in the same time period.

Escorts: The company is an engineering conglomerate with business segments in agri machinery, construction equipment and railway equipment. Domestic funds stake in the company rose from 3.59 per cent in December 2016 quarter to 5.78 per cent in December 2017 quarter. In Q3FY18, the company posted a health operating profit growth and net profit growth of 54.2 per cent and 71.7 per cent respectively. The stock delivered 187.7 per cent returns between 30 December 2016 and 20 February 2018 and outperformed the market by over 6 times. BSE500 index delivered 31.2 per cent returns during the same period.

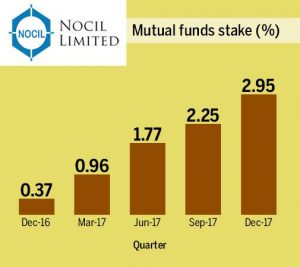

Nocil: The Company is engaged in the business of manufacturing and trading of rubber chemicals. Mutual funds have raised their stake in the company from 0.37 per cent in December 2016 quarter to 2.95 per cent in December 2017 quarter. It posted top line and bottom line growth of 27.4 per cent and 80.7 per cent respectively in Q3FY18. The net profit margins improved to 18 per cent in Q3FY18 from 12.7 per cent in Q3FY17. The stock returned 173.1 per cent between 30 December 2016 and 20 February 2018. It outperformed the market by 5.5 times. BSE500 index delivered 31.2 per cent returns during the same period.

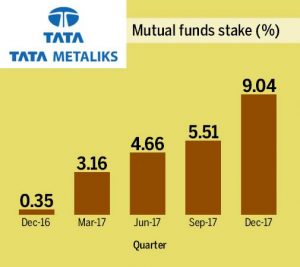

Tata Metaliks: The company is a subsidiary of Tata Steel, and produces pig iron and ductile iron pipes in India. It has its manufacturing plant at Kharagpur, West Bengal, India. Mutual funds have increased their stake in the company from 0.35 per cent in December 2016 quarter to 9.04 per cent in December 2017 quarter. The company posted a 67.9 per cent jump in operating profit with 105.8 per cent growth in net profit in Q3FY18. The stock outperformed the market by over 4.7 times and delivered 178 per cent point to point returns between 30 December 2016 and 20 February 2018. BSE500 index earned 31.2 per cent in the same time period.

Dewan Housing Finance Corporation: A housing finance company that focuses on providing financing products to the lower and middle-income segments in India, primarily in Tier II and Tier III cities, and towns. Domestic mutual funds have raised their stake in the company from 3.17 per cent in December 2016 quarter to 7.31 per cent in December 2017 quarter. In Q3FY18, company’s net sales and other operating income grew by 9.7 per cent whereas its total expenditure increased by 47.1 per cent. It reported a bottom line growth of 24.9 per cent helped substantial increase in other income that grew by over 211 per cent. The stock outperformed the market by nearly 4 times between 30 December 2016 and 20 February 2018. It delivered point to point returns of 123.7 per cent compared to BSE500 index that delivered 31.2 per cent returns.