Volatility index which is already near 4-year high is trading is expected to surge further as we head towards May 23. It is when stocks which are trading at a premium could face some pressure

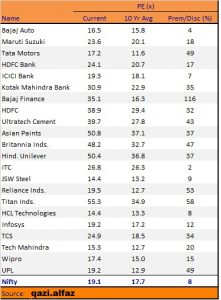

Despite a recent downtick in benchmark indices that were trading at their all-time highs not long ago, there are 22 stocks in the Nifty50 that are trading at a premium to their 10-year PE average.

PE multiple or price-to-earnings ratio is a valuation metric that measures the current stock price relative to the company’s earnings. It is also sometimes referred to as earnings multiple.

Volatility index, which is already near 4-year high, is expected to surge further as we head towards May 23 when election results will be announced. It is when stocks which are trading at a premium could face some pressure.

These stocks include Bajaj Auto, Maruti Suzuki, ICICI Bank, Kotak Mahindra Bank, Asian Paints, ITC, Titan Company, UPL, among others, according to data from Motilal Oswal.

Now the question is if someone holds the stock, is it time to book profits? Experts suggest not all stocks will qualify to be sold to book profits as factors could be industry specific.

“We continue to like Britannia Industries and Titan despite premium valuations. Titan happens to be part of our top ten India bets. However, we recently downgraded Reliance from buy to neutral owing to rich valuations,” Gautam Duggad, Head of Institutional Research, Motilal Sowal told Moneycontrol.

Sumeet Bagadia, Executive Director, Choice Broking told Moneycontrol that after a good upside movement in the benchmark index, these stocks are trading in an ‘overbought’ zone that signals for a correction.

“Part profit booking strategy would be fruitful. Moreover, if stocks fall after selling, one can buy again. It will also bring down the overall cost of the holding portfolio,” he said.

Other parameters to track

Tracking PE ratio is one of the parameters to filter stocks but investors should combine other parameters before deciding to buy or sell.

Some analysts emphasise on business cycles while others advise investors to keep an eye on specific ratios that define fundamentals of the company such as D/E ratio, PEG ratio, PEER performance, industry growth, etc.

“Business cycle is the most important parameter. Business in an upcycle will see their PEs rise; while in a down cycle, they will shrink. Understanding business cycles that involves tracking the key changes in the industry like competitive intensity, technological changes, changes in an entry or exit barriers, regulatory environment and many others are far more critical parameters which decide stock returns in the medium to long-term,” explains Naveen Kulkarni, Head of Research, Reliance Securities.

Dharmesh Kant, Head-Retail Research, IndiaNivesh Securities Ltd is of the view that the most important parameter is the growth trajectory in future and consistency of business.

“These can be evaluated through PEG ratio, projected cash flows, capacity utilization PEER performance, industry growth, operating profit margin trend, D/E ratio and ROE,” he said.