Income tax new regime benefits: Experts say that in the coming time, there is a preparation to make the new tax regime the only tax system. But, currently the exemptions which are available in the old tax regime are not available.

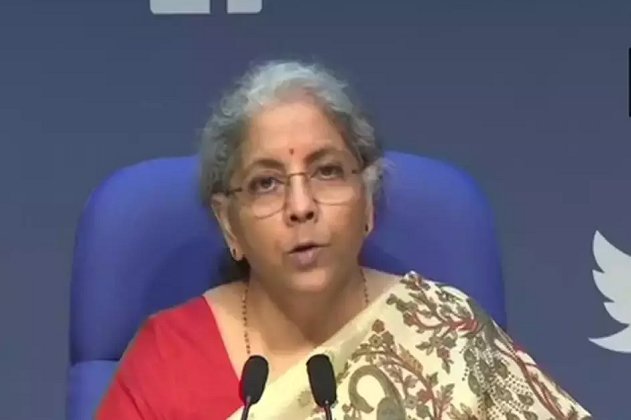

Income tax new regime benefits: Some changes were made in the income tax rules in the budget of 2020. New tax system added. This is known as New Tax Regime. Some new changes were made in this new tax regime in the budget of 2023. Standard deduction added. Also, those with income up to Rs 7 lakh were exempted from tax. The matter did not stop here. Finance Minister Nirmala Sitharaman made the new tax regime the default tax system from the financial year 2023-24. Now when we pay investment tax or when we file income tax return, the new tax regime will be the default. Experts say that in the coming time, there is a preparation to make the new tax regime the only tax system. But, currently the exemptions which are available in the old tax regime are not available. Therefore, attention can be paid towards making it more attractive. If sources are to be believed, changes may be made this time.

EPF benefit can be added

If sources are to be believed, attention can be paid to making the new tax regime more attractive in the budget. The most important thing for an employee is Employee Provident Fund (EPF). This can be included in the new tax regime. Till now, in the old tax regime, EPF can be used for tax exemption under Section 80C. This is included as a deduction in Form 16 by the employer. But, its benefit is available only in Section 80C, where tax exemption is only up to Rs 1.5 lakh. There are chances of opening the window of 80C if it is added to the new tax regime. However, it is not yet confirmed whether it will be included as 80C or will be given as additional tax exemption.

Preparation to open the way for 80C

According to tax experts, while implementing the new tax regime, it was indicated that this tax system would be implemented gradually. Standard deduction was first added in this series. Now if the category of EPF is added then taxpayers will get the benefit of additional tax exemption. This gives another indication that 80C avenues for tax exemption are being opened. If EPF is added then other deductions can also be added in future. But, the government will not provide all the benefits directly because the old tax regime is still in the system.

What are the exemption provisions in the new tax system?

Some changes were made in the new tax regime in the year 2023. Basic exemption limit increased from Rs 2.5 lakh to Rs 3 lakh. At the same time, the tax exemption limit with rebate has now increased from Rs 5 lakh to Rs 7 lakh. Tax rebate was extended for this structure. Apart from this, there is a tax exemption of Rs 50,000 as standard deduction. In such a situation, there is no tax on total savings up to Rs 7.5 lakh in the new tax regime.

New Tax Regime 2023-24

| Income | tax rate |

| 0 to 3 lakh | Zero |

| 3 to 6 lakhs | 5 percent |

| 6 to 9 lakhs | 10 percent tax |

| 9 to 12 lakhs | 15 percent tax |

| 12 to 15 lakhs | 20 percent |