New Tax Regime: The biggest advantage of the new regime is higher standard deduction. However, it must be kept in mind that the benefit of standard deduction is available to employed people. If you are a professional, self-employed or businessman, you will not get its benefit.

New Tax Regime: Employed people have to tell their employer about their tax-savings plan. They also have to tell which of the new and old regimes of income tax they want to use in the new financial year. This has become very important because the relief announced by Finance Minister Nirmala Sitharaman for taxpayers in the new regime of income tax in the Union Budget presented on February 1 this year has come into effect from April 1.

Major changes in the new regime will come into effect from April 1

The Finance Minister had said that if the annual income is up to Rs 12 lakh, then no tax (Income Tax) will have to be paid. This relief was for the new regime of income tax. He also changed the tax slabs of the new regime. Now in the new regime, 30 percent tax will have to be paid only by those taxpayers whose income is more than Rs 24 lakh per annum. After the announcement made in the budget this year, the attraction of the new income tax regime has increased.

Three big benefits of the new regime

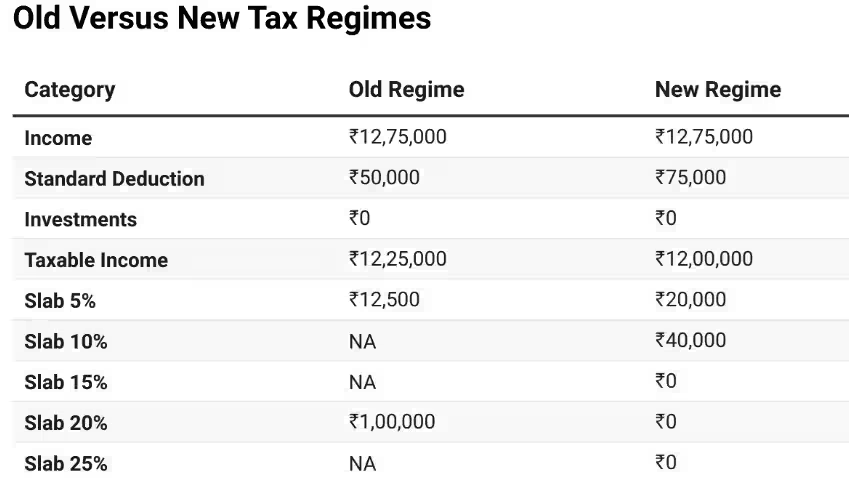

The biggest benefit of the new regime is more standard deduction. However, it has to be kept in mind that the benefit of standard deduction is available to employed people. If you are a professional, self-employed or businessman, then you will not get its benefit. The second benefit is that in this regime, no tax has to be paid on income up to Rs 12 lakh. The third benefit is its easy tax structure i.e. slabs. If a person’s basic salary is Rs 12.75 lakh, then he can do tax-savings of Rs 1,87,200 in the new regime. We can understand this from the table given below.

There is no benefit of deduction in the new regime

The special thing about the old regime is that it offers the benefit of deduction. Taxpayers can claim deduction under Section 80C, Section 80D of Income Tax. Deduction can be claimed on home loan interest under Section 24B. House Rent Allowance (HRA) can be claimed. If a taxpayer claims a deduction of up to Rs 8 lakh by combining all types of deductions, then only the old regime can be beneficial for him.

Deduction is available in these sections

In the old regime, deduction can be claimed by making tax-saving investments of up to Rs 1.5 lakh annually under Section 80C. Deduction is available on health policy under Section 80D. A person below the age of 60 can buy a health policy for himself and his family and claim a deduction of Rs 25,000 annually on its premium. If the age of the person is 60 years or more, then he can claim a deduction of Rs 50,000 on the premium. He can also claim a deduction of Rs 50,000 annually by buying a health policy for his elderly parents.

New and old regime of income tax

| Income | The Old Regime | Income | New Regime |

| 0 to Rs 2.5 lakh | 0% | 0 to 4 lakh rupees | 0% |

| Rs 2.5 lakh to Rs 5 lakh | 5% | Rs 4 lakh to Rs 8 lakh | 5% |

| Rs 5 lakh to Rs 10 lakh | 20% | Rs 8 lakh to Rs 12 lakh | 10% |

| More than Rs 10 lakh | 30% | Rs 12 lakh to Rs 16 lakh | 15% |

| Rs 16 lakh to Rs 20 lakh | 20% | ||

| Rs 20 lakh to Rs 24 lakh | 25% | ||

| More than Rs 24 lakh | 30% |

Most Read Articles:

- LIC’s superhit policy, pay 4 premiums and get Rs 1 crore with guarantee sitting at home, know how?

- Credit card hidden charges: 5 Hidden charges will be imposed as soon as you take credit card – Bank does not tell, must know before apply

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide