New Wage Code: Take home salary, PF and Gratuity of a private job worker will change completely. In this code, the cash in hand salary of the private employer will be reduced.

New Wage Code: There is a lot of discussion about Cost to Company (CTC) in the new Wage Code. Four labor codes will be implemented in the country soon. Now 90 percent of the states have prepared the draft rules. It is expected that the New Wage Code will be implemented in the year 2022. The Labor Ministry has made preparations for this. If this happens then it will completely change the Take Home Salary, PF and Gratuity of the private job worker. According to experts, the monthly salary will decrease but more funds will be ready in EPF. This will give more money on retirement.

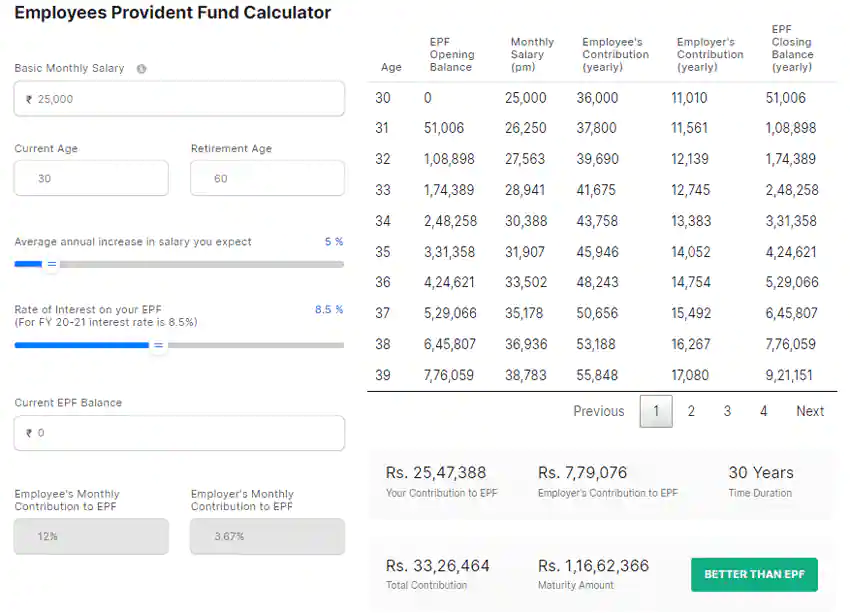

New Wage Code Calculation

In the New Wage Code, the basic salary will be 25 thousand rupees per month. Then the EPF amount on retirement will be Rs 1,16,62,366. Here the annual increment has been taken at 5 percent, due to which the EPF fund will increase further.

New Wage code PF Benefits: If the monthly salary is 50 thousand rupees and the basic pay will be 15 thousand rupees. Then the amount of PF on retirement will be Rs 69,97,411.

New Wage code: What is Cost to Company

CTC is the expenditure incurred by a company on its employee. This is the complete salary package of the employee. CTC includes Monthly Basic Pay, Allowances, Reimbursement. At the same time, products like gratuity, annual variable pay, annual bonus are included on an annual basis. The amount of CTC is never equal to the employee’s take home salary. CTC has many components so it is different. CTC = Gross Salary + PF + Gratuity

Basic salary

EPF Calculator New Wage Code: Basic salary is the base income of an employee. It is fixed based on the level of all the employees. It varies according to the rank of the employee and the industry in which he is working.

Gross salary

PF Calculator New Wage Code: The salary which is made by adding basic pay and allowances without deducting tax is called gross salary. This includes bonus, overtime pay, holiday pay and other itemized allowances.

Gross Salary = Basic Salary + HRA + Other Allowances

Net salary

Net salary is also called take home salary. The salary that is made after deducting tax is called net income.

Net Salary = Basic Salary + HRA + Allowances – Income Tax – EPF – Professional Tax

What allowances are included

PF Calculator online: The company gives allowances to the employee in lieu of the job. This may vary from company to company.

> HRA : House Rent Allowance is given to the employee in lieu of the house on rent.

> LTA : LTA is the cost of domestic travel to the employee. It does not include food, hotel fare.

> Conveyance Allowance: Conveyance allowance is given to the employee in lieu of the expenses incurred in going home from office.

> Dearness Allowance: DA is a living allowance. It is given in lieu of inflation. Its eligible are government employees and pensioners.

> Other allowances include special allowance, medical allowance and incentive or incentive.

And what perks are included

New Wage Code: According to experts, in many companies there is a provision to reimburse the employee for treatment, phone expenses, newspaper bill. This amount is available separately from the salary. But only after paying the bill. Under the Income Tax Act, every reimbursement is tax exempt up to a limit.