NEW DELHI: As Finance Minister Nirmala Sitharaman tables her fourth Union Budget in the Parliament tomorrow, a wild trading session awaits Dalal Street. Concerns over likely populist measures ahead of key state elections are partly keeping traders jittery. Chances of the stock market performing well a day after the Budget too are low. This is, if history is to go by.

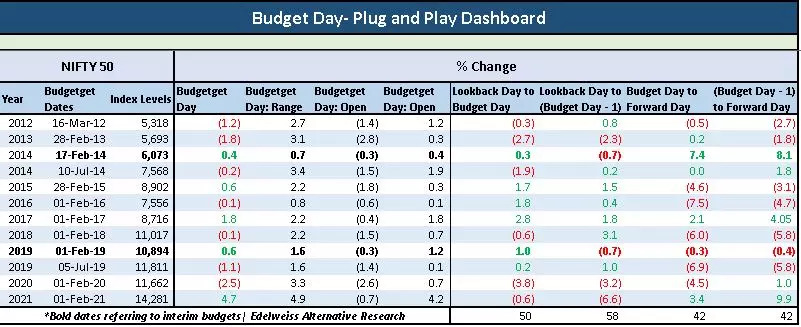

In the last 10 budgets (excluding the interim Budgets of 2019 and 2014), Nifty50 has fallen seven times on D-Days. Besides, the last few years have seen extreme volatility on Budget days as suggested by the daily index movements.

For example, Nifty50 moved in a 4.9 per cent range last year on Budget day, where it eventually closed the day 4.7 per cent higher. On February 1, 2020, the index ended 2.5 per cent lower after trading in a wide range of 3.3 per cent. In 2019, on July 5, the NSE barometer moved in the 1.6 per cent range to eventually close 1.1 per cent lower.

In 2018, the index swung in a 2.2 per cent range only to edge 0.10 per cent lower. In 2017, the market gained 1.8 per cent on D-Day after gyrating 2.2 per cent.

In 2013 and 2012, the index fell by 1.8 per cent and 1.2 per cent, respectively, on Budget days. In 2014, when Modi government presented its first Budget, the index saw a 3.4 per cent movement before closing the day 0.2 per cent lower. 2015 also saw over 2 per cent Nifty movement on Budget day, but the index ended 0.6 per cent higher.

What stock investors want?

In 2004, security transaction tax (STT) had replaced long-term capital gains (LTCG) tax. But Budget 2018 brought back LTCG, which is being levied at a rate of 10 per cent on annual gains of over Rs 1 lakh. This was done even as STT was not abolished.

Now with many new investors flocking to equity markets in the last 12–18 months, STT removal could encourage investors to start trading, said William O’Neil India in a note.

At present, STT on non-delivery transactions is 0.025 per cent and 0.1 per cent for delivery.

Although investors also want LTCG to be removed, the government, in the winter session of parliament, said there are no plans to abolish LTCG tax on equities and mutual funds.

Long-term capital gains (LTCG) arising out of the sale of listed equity shares and units of equity-oriented mutual fund schemes are taxed at the rate of 10 per cent if the LTCG exceeds Rs 1 lakh in a financial year.

“While there are hopes that Budget 2022 would see STT removed, it is estimated that with increasing investors and trade volumes in the market, STT could generate more than Rs 5,000 crore in revenue. LTCG collection for AY 2019-20 and AY 2020-21 was Rs 3,460 crore and Rs 5,311 crore, respectively. Looking at those numbers, it is unlikely the government would make a change here,” William O’Neil India said in a note.

What stock investors fear?

With 7 states going into elections in CY22 and 5 of them gearing up for it from February 10th onwards, concerns around this Budget turning into a populist one are simmering, said BofA Securities. “Despite the polls pressure, we expect the FY23 Union Budget to stick to the reform agenda,” it said.

Emkay Global said policy challenges remain very similar to last year, except that this year is a heavy election year and may have some populist bias.

“All eyes would now be on how the government manages the fine balance of propelling economic growth and fiscal management in FY23. Markets are understandably obsessed with the headline target to gauge the fiscal policy stance. The policy perception of the cost of trade-off between growth and possible market stability amid tighter global financial conditions would decide whether the fiscal stance will be pro-cyclical or counter-cyclical in nature,” Emkay said.