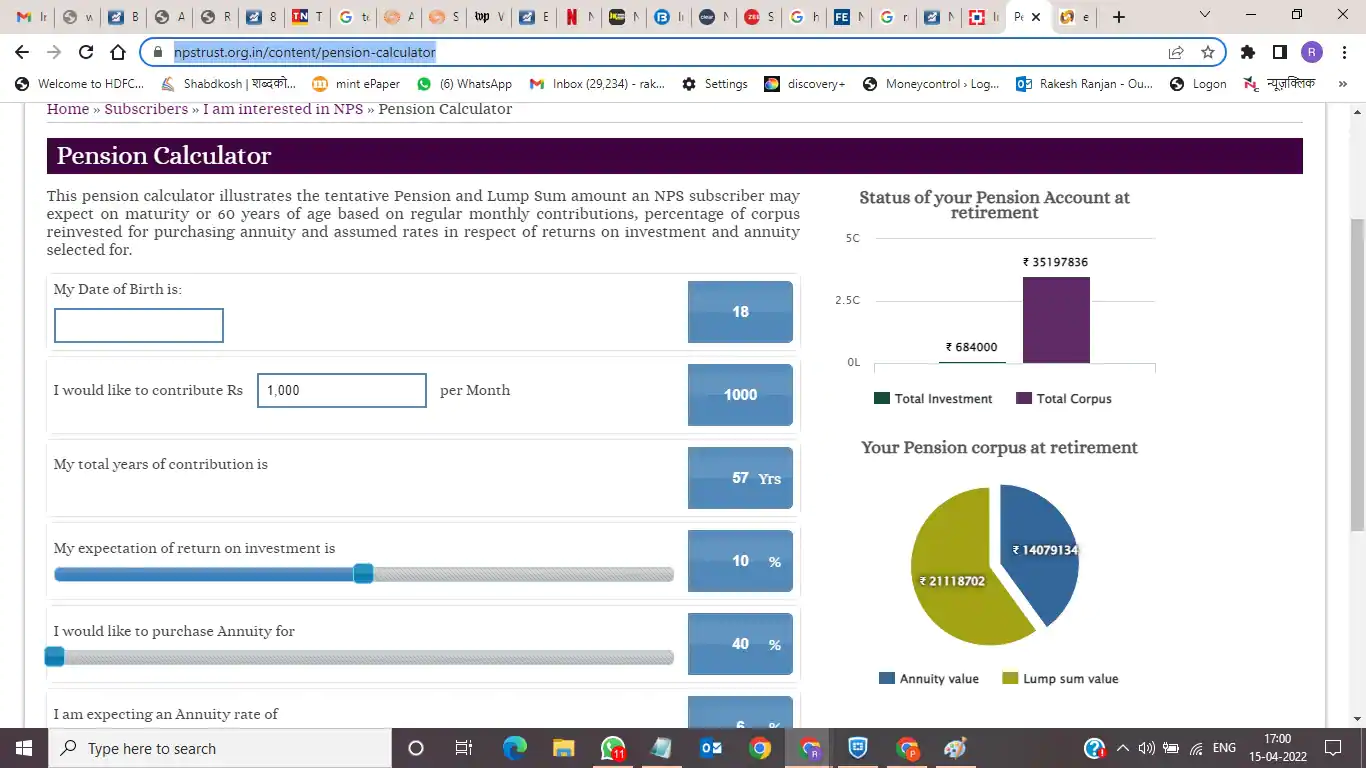

The pension calculation itself can be done from the pension calculator available on the website of NPS Trust. If you want to invest more than Rs 5000 per month, then with the help of calculator you can find out the pension you will get on it.

Have you done retirement planning? Retirement planning means arranging income for the time when you would have retired from the job. Then you won’t have the ability to run around a lot. You have to take more care of health too.

In fact, many people don’t think much about post-retirement expenses. This reduces the chances of creating a large corpus for retirement. The sooner retirement planning is done, the better. For this you can take the help of National Pension Scheme.

Anyone in the age group of 18 to 65 years can start investing in NPS. The investment in NPS is managed by the pension fund manager. The Pension Fund Regulatory and Development Authority (PFRDA) appoints the Pension Fund Manager. PFRDA is the regulator of National Pension Scheme.

The PFRDA was set up by the government in 2003. You can choose from a total of 7 Pension Fund Managers. These include LIC Pension Fund, HDFC Pension Management Company, SBI pension fund.

One can invest in pension funds till the age of 60 years. After that you have to buy an annuity plan. You can buy an annuity plan from any of the six annuity providers. These include HDFC Life Insurance Company, LIC, ICICI Prudential Life Insurance. You will get pension every month from annuity providers.

A person of 30 years can get a pension of Rs 22,279 per month by investing just Rs 5,000 in NPS every month. Apart from this, he will also get a lump sum amount of Rs 45,5 lakh. He has to invest an amount of Rs 5,000 till the age of 60 years. An annual interest rate of 10 per cent and an annuity rate of 6 per cent has been estimated for this estimate.

You can check it yourself from the pension calculator available on the NPS website . If you want to invest more amount every month, then with the help of calculator, you can find out the pension on it.

Tax benefits are also available on investment in NPS. If you are employed, you can get deduction of Rs 50,000 per annum by investing in NPS under section 80CCD(1B). This is different from the deduction of Rs 1,50,000 lakh available under 80C.