You can link your Aadhar card and PAN card with each other in many ways. This work can be done by visiting the website of Income Tax Department.

PAN and Aadhaar Link: Have you linked your PAN card with Aadhaar card or not? If not, then do this work immediately. Because the last date of PAN-Aadhaar linking is approaching. The last date for linking PAN card with Aadhar card is March 31. By linking PAN card and Aadhar card, you can do e-verification of Income Tax Return (ITR). Hence link PAN-Aadhaar for quick and easy e-verification of Income Tax Returns.

If your PAN card is not linked with Aadhar card till the given deadline, then you may have to pay a fine for this. Let us know how you can link your Aadhar card with PAN card.

Income Tax Department shared link

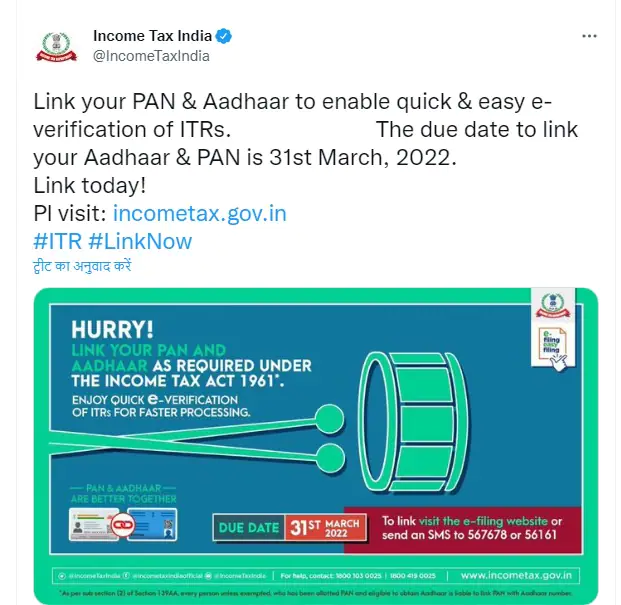

The Income Tax Department has said on its social media account Twitter that link PAN and Aadhaar for easy e-verification of ITR. Income Tax Department further writes – Link today. Along with this message, the tax department has also shared a link www.incometax.gov.in to get PAN and Aadhaar. By visiting this link, you can link your PAN card and Aadhar card.

Aadhar card issuing body UIDAI has also said on its Twitter- ‘Income TaxThe easiest way to e-verify your return is your #Aadhaar. If your Aadhaar is linked with PAN, then you will be able to e-verify ITR easily. Please note that your mobile number should be registered with Aadhaar to avail this facility.

You can link your Aadhar card and PAN card with each other in many ways. This work can be done by visiting the website of Income Tax Department. You can link both of them by sending a message. Here we are discussing the easy ways to link PAN and Aadhaar-

Income tax department link

- First of all, you have to click on the Income Tax Department link https://www.incometaxindiaefiling.gov.in/home. Now click on Link Aadhaar.

- Here you have to fill your details. In this, you have to enter your PAN number, Aadhar number, name and registered mobile number. In this your PAN card will be linked with Aadhar card.

- You can link Aadhaar with PAN card by sending a message to 567678 or 56161 from your registered phone number.

Check status like this

If your PAN card is linked with Aadhar number or you have got it linked, then you can check the status. For this, first of all go to the website of Income Tax Department www.incometaxindiaefiling.gov.in. Here click on the option of Link Aadhaar.

To view your status, click on the hyper link Click here. Here you have to fill your Aadhar and PAN card details. If your PAN card is linked to Aadhar card, then you will see this confirmation that your PAN is linked to Aadhaar Number.