New Delhi. While fulfilling the responsibilities of the family in youth, along with fulfilling all the wishes, the tension of old age keeps on haunting. If there is no government job in that too, then the tension increases further.

To address these concerns, the Central Government has launched Atal Pension Yojana (APY). Every day many people are joining this pension scheme. There are many special things about this pension scheme. Firstly, in a pinch of investment, after 60 years, you will continue to get the benefit of lifelong pension. Apart from this, there are many benefits which we are going to mention…

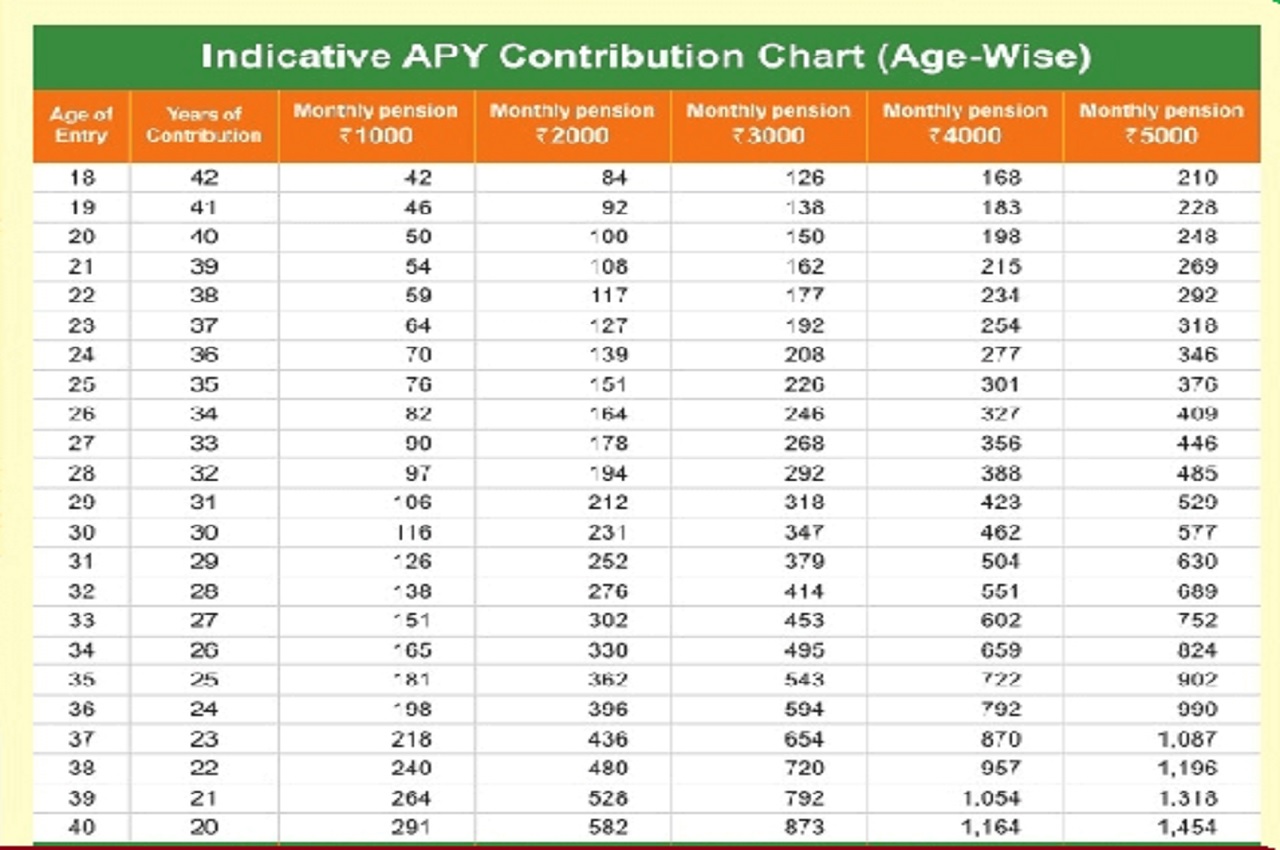

The minimum investment in this scheme is Rs 210 per month. This Rs 210 will give a monthly pension of Rs 5000 after 60 years. The investment installment in the pension scheme is decided according to the age. The special thing is that both husband and wife can take advantage of it. In such a situation, after 60 years on a monthly investment of Rs 420, you will continue to get a pension of Rs 10,000 per month for life.

This is the eligibility to join the scheme

To join this scheme, the age should be minimum 18 years and maximum 40 years. Investment installments have also been divided according to the age of 18-40. Apart from this, if the amount of pension received is to be kept low, then the monthly investment also gets reduced further. That is, taking advantage of pension scheme at the age of 18, after 60 years, monthly pension is 1000 rupees, 42 rupees a month, 2000 rupees 84 months, 3000 rupees 126 rupees and 4000 rupees 168 months. On the other hand, if you want a pension of Rs 5000 per month, then there will be an installment of Rs 210 per month, which will have to be deposited for 42 years. From this chart you can easily get the information of installments.

Since the minimum amount of pension has been fixed at 1000 monthly and maximum 5000 monthly. The amount of pension is also taken into account while paying the premium. On the death of the person taking pension under this scheme, that pension nominee will continue to get it for life. That is, some member of the house will continue to take advantage of this pension.

Under this scheme, an income tax deduction of 50,000 will be provided to the investor under section 80 CCD (1B) in the income tax on taking a pension plan. If the beneficiary of the pension dies before the age of 60, the pension will also be provided to his nominee. It can be availed by opening an account in any bank or post office.