Physical Gold Vs Digital Gold: The festival of Akshay Tritiya (Akshay Tritiya 2024) will be celebrated in the country on 10 May 2024. It is auspicious to buy gold on this day. Currently we can buy digital gold along with physical gold. Let us know in this article which of these two options should be invested in on Akshaya Tritiya this year.

Physical Gold Vs Digital Gold: The festival of Akshaya Tritiya (Akshaya Tritiya 2024) is on 10 May 2024. It is believed that buying gold on this day brings blessings of Goddess Lakshmi. There is a very old tradition of buying gold in India.

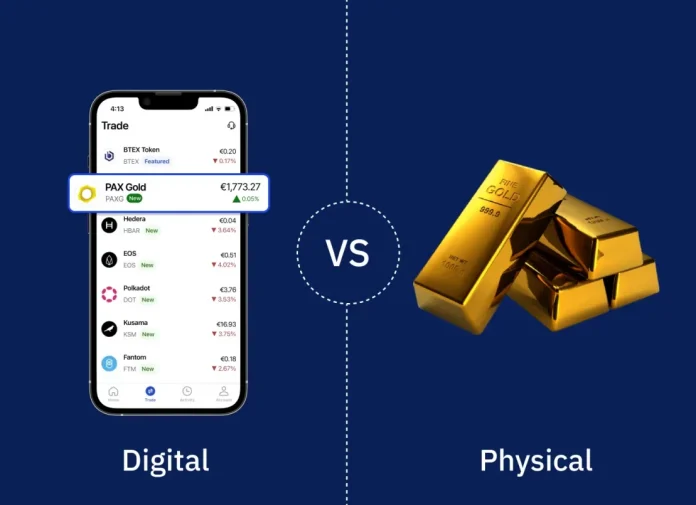

Today, we have two options for gold investment – physical gold and digital gold. Now in such a situation the question arises that which of these two options is best for us?

According to market expert Dr. Ravi Singh

Investing in digital gold this Akshaya Tritiya provides an attractive alternative to traditional gold jewellery. Investing in digital gold offers a convenient and safe way to avoid store expenses and the possibility of theft. Investing in digital gold can provide a stable protection against inflation and market fluctuations, providing the same benefits as physical gold but without the additional expense. Digital gold is a very good option this Akshaya Tritiya.

Why invest in digital gold

If you want to invest in gold then select digital gold. At present, along with digital gold, Sovereign Gold Bond is also a very good option. The biggest feature of digital gold is that you do not have any problem regarding the quality of gold.

Apart from this, if you invest in digital gold for a long time, you get the same returns as physical gold. Let us first understand the difference between SGB and digital gold.

What is the difference between Sovereign Gold Bond and Digital Gold (SGB Vs Digital Gold)

- Sovereign Gold Bond is a gold investment scheme. It has a lock-in period of 5 years i.e. you cannot withdraw it for 5 years. You can buy or sell digital gold anytime.

- If you buy digital gold, you have the option to convert it into physical gold. This type of option is not available in Sovereign Gold Bond.

- SGB scheme has been launched by RBI. The central bank takes full guarantee of SGB but no regulator monitors digital gold.

- You can deposit digital gold in any secured vault, for this you do not have to pay any charge. Sovereign gold bonds cannot be stored. Actually, SGB is a kind of paper gold.

- In SGB you have to buy at least 1 gram of gold, whereas digital gold can be bought even for 1 rupee.

- Sovereign Gold Bond gives an annual interest of 2.5 percent. This kind of interest is not available in digital gold.

Let us tell you that you can take loan against digital gold and sovereign gold.

Why should you invest in digital gold (Physical Gold Vs Digital Gold)

- There is a risk of physical gold being stolen or lost. Whereas there is no such risk in digital gold.

- Digital gold can be purchased easily as compared to physical gold. If you want, you can buy digital gold on online mode even while sitting at home.

- Storage or transaction fees in digital gold are lower than physical gold. Apart from this, more tax benefits are also available on digital gold as compared to physical gold.