The objective of the Pradhan Mantri Mudra Yojana (PMMY) of the Government of India is to provide loans to non-corporate and non-farm small / micro enterprises. Under this, a maximum loan of up to Rs 10 lakh can be taken. There are three categories of loans available.

Pradhan Mantri Mudra Yojana (PMMY) is a central government scheme. It aims to provide loan facility up to Rs 10 lakh to non-corporate and non-farm small/micro enterprises. It was started by PM Modi on April 8, 2015. According to government data, in the 7 years since then, loans worth Rs 18.60 lakh crore have been disbursed under the scheme. For this, a total of more than 34.42 crore loan accounts have been opened.

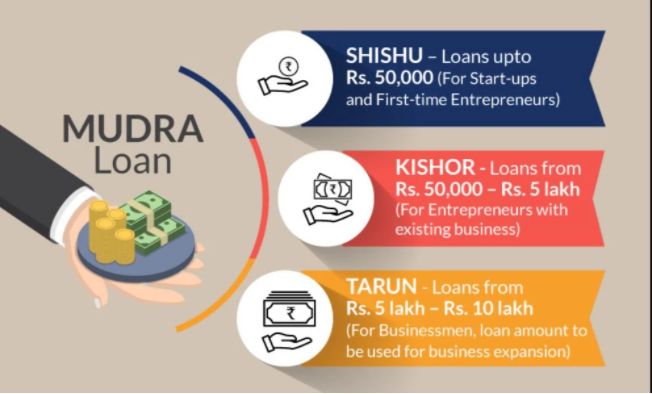

Three types of loan

Under the Pradhan Mantri Mudra Yojana, loans up to Rs 10 lakh are available through banks, non-banking financial companies (NBFCs) and small financial institutions (MFIs) etc. This loan is given in three categories- ‘Shishu’, ‘Kishor’ and ‘Tarun’.

Shishu Loan: Up to Rs 50,000.

Kishor Loan: Above Rs 50,000 and below Rs 5 lakh.

Tarun Loans: Above Rs 5 lakh and up to Rs 10 lakh.

For what purposes loan is given?

Loans are given under PMMY for manufacturing, trading and service sectors and agriculture related activities such as poultry, dairy, bee keeping etc.

What is the interest rate?

As per the RBI guidelines, the interest rate is decided by the lending institutions. In case of working capital facility, interest is charged on the borrower’s loan only after the expiry of one day.

Who can take loan?

Any citizen of India with a business plan in non-farm sector income-generating activity such as manufacturing, processing, trading or service sector, can apply for MUDRA loan under Pradhan Mantri Mudra Yojana (PMMY).

For this any person, male or female, proprietorship-based establishment, partnership firm, private limited company or other body can apply. For this, the conditions of the lending bank or agency have to be followed.