Post Office RD: 16 lakh rupees can be made by saving 10 years in the post office recurring deposit scheme. The best thing about post office schemes is that they offer low investment every month and guarantee returns.

Most of the people invest in the post office for the safety of their capital as well as guaranteed returns. There is no risk on the money invested in post office schemes. The post office offers you many types of Small Savings Schemes. One of these is the Post Office Recurring Deposit scheme, about which we are telling you. In this scheme, you have to deposit a fixed amount every month. At the time of maturity, you will get the full amount including interest.

The biggest advantage of Post Office Recurring Deposit (Post Office RD) is that you can create a huge capital for the future even with small savings. Another good thing is that you do not even have to worry about the security of your savings. If you want, you can also save at least 1000 rupees every month. However, there is no limit on the maximum investment in Post Office Recurring Deposit.

How much interest will you get?

Recurring deposit account can be opened for at least 5 years in the post office. You cannot open a post office recurring deposit account for less than this. The central government revises the interest rates of all small savings schemes every three months. At present, interest at the rate of 5.8 percent is being available on Post Office Recurring Deposit (PO RD Interest Rate).

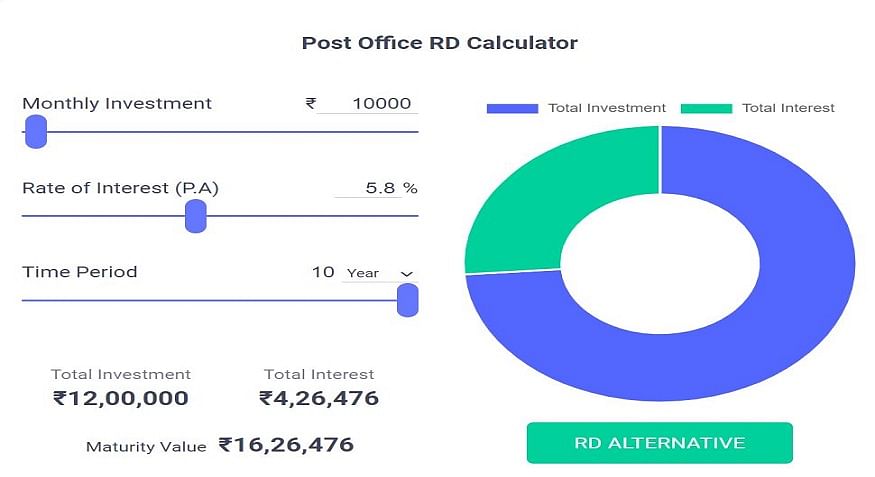

How to get 16 lakh rupees after 10 years

If you save 10 thousand rupees every month in post office recurring deposit at the current rate of interest, then after 10 years you will get a total of more than 16 lakh rupees. According to the savings of Rs 10,000 every month during these 10 years, a total of Rs 12,00,000 will be saved. During this, you will get Rs 4,26,476 as interest at the rate of 5.8 percent. In this way you will be able to get a total of Rs 16,26,476.

Keep these things in mind

But you also have to keep in mind that you may also have to pay a penalty for not paying the installment of the recurring deposit. In case of delay in installment, one per cent penalty will be payable every month. If a person does not deposit the installment for 4 consecutive months, then his account can be closed. However, it can be reactivated even after the account is closed.