Public Provident Fund (PPF) is most popular because the money deposited in it, the interest received and the amount received on maturity are completely tax free. Meaning it is kept in EEE category. EEE means Exempt.

Most people are looking for where to invest their money. But, the matter is not only about investment but also how much income will be earned from it and also remain out of the scope of income tax. Public Provident Fund (PPF) removes this worry of the people. Investing in this scheme gives the option of secure future and tax savings with good returns. If you are doing retirement planning or want to earn good income from investments in the long term, then you can choose this scheme. This scheme is more popular by the name of PPF.

Why Public Provident Fund (PPF) is most popular?

Public Provident Fund (PPF) is most popular because the money deposited in it, the interest received and the amount received on maturity are completely tax free. Meaning it is kept in EEE category. EEE means Exempt. There is an option to claim tax exemption on deposits every year. No tax has to be paid on the interest received every year. Once the account matures, the entire amount will remain tax free.

Who can do PPF?

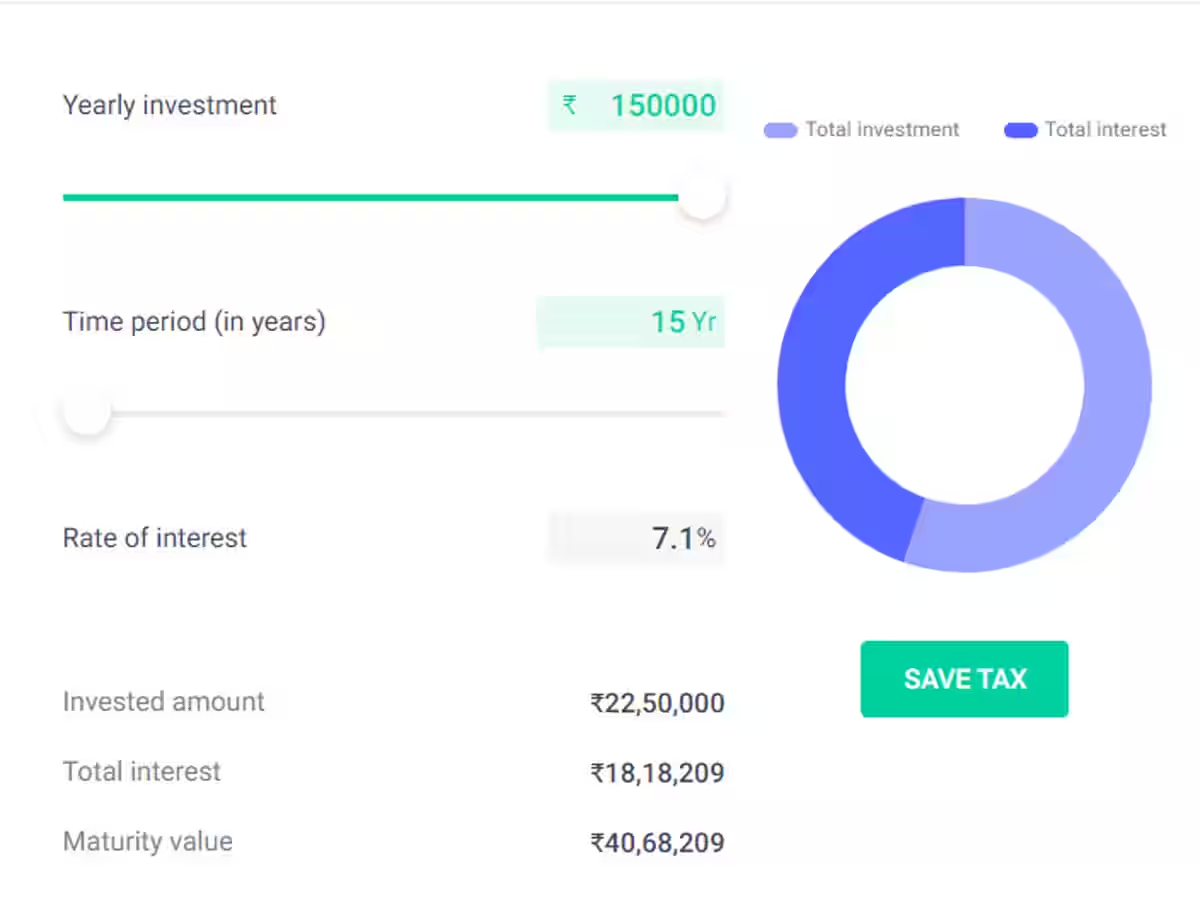

Small savings scheme PPF is for any citizen of the country. It can be opened in post office or any bank. A minimum of Rs 500 and a maximum of Rs 1,50,000 can be invested every financial year. Interest is calculated on an annual basis. However, interest is decided on quarterly basis. At present, 7.1 percent interest is being given on PPF. The maturity period lasts for 15 years. There is no facility to open joint account in the scheme. However, a nominee can be made. There is no option to open PPF account even in the name of HUF. In case of children, the name of the guardian is included in the PPF account. But, it remains valid only till the age of 18.

How will PPF make a millionaire?

PPF is such a scheme in which it is easy to become a millionaire. This requires regular investment. Suppose you are 25 years old and you have started PPF. If you deposit Rs 1,50,000 (maximum limit) in the account between 1st to 5th of the financial year, then Rs 10,650 will be deposited only in interest at the beginning of the next financial year. Meaning, on the first day of the next financial year your balance will be Rs 1,60,650. By doing the same again next year the account balance will be Rs 3,10,650. Because, Rs 1,50,000 will be deposited again and then interest will be given on the entire amount. This time the interest amount will be Rs 22,056. Because, the formula of compound interest works here. Now suppose 15 years of PPF maturity have been completed, then you will have Rs 40,68,209 in your account. Of these, the total deposit amount will be Rs 22,50,000 and Rs 18,18,209 will be earned only from interest.

Benefit of extension in PPF account

PPF was started at the age of 25. At the age of 40, an amount of more than Rs 40 lakh is in hand on maturity of 15 years. But if the planning is for long term then the money will grow faster. After maturity in PPF, the account can be increased by extension for 5 years. If the investor extends the PPF account for 5 years, then by the age of 45 the total amount will be Rs 66,58,288. The investment in this will be Rs 30,00,000 and the interest income will be Rs 36,58,288.

Will become a millionaire at the age of 50

The goal of becoming a millionaire will now be accomplished. PPF account has to be extended once again for another 5 years i.e. up to 25 years. Again you will have to invest Rs 1,50,000 annually. At the age of 50, a total of Rs 1,03,08,014 will be deposited in the PPF account. The investment in this will reach Rs 37,50,000 and the interest will reach Rs 65,58,015.

How much will your money increase at the age of 55?

The second feature of PPF is that you can extend it for 5 years any number of times. Now once again if the account is extended for 5 years, then at the age of 55 you will have Rs 1 crore 54 lakh 50 thousand 910. The investment in this will be only Rs 45,00,000, but the interest income will exceed Rs 1 crore and the total income will be Rs 1,09,50,911.

Now the turn of retirement will come

If you have invested in it for retirement, then PPF will have to be increased once again for the last 5 years. Meaning overall the investment will continue for 35 years. In this case, maturity will be at the age of 60. In this case, the total amount of deposit in PPF account will be Rs 2 crore 26 lakh 97 thousand 857. The total investment in this will be Rs 52,50,000, while the interest income will be Rs 1 crore 74 lakh 47 thousand 857.

Peace of mind because no tax will be levied

When you retire at the age of 60, there will be no tax on the huge amount of above Rs 2 crore deposited in PPF. Generally, if you earn such a huge amount from somewhere else, you will have to pay heavy tax on it. If both husband and wife operate PPF account together for 35 years, then the total balance of both will be Rs 4 crore 53 lakh 95 thousand 714.