PPF Investment Formula: Be it interest or tax free investment or the amount received on maturity. This is an excellent investment tool in every respect. The maturity period is 15 years. But, the formula after 15 years does not make the money grow.

You must have heard about the specialty, interest and popularity of Public Provident Fund. This scheme is for any Indian citizen. This is the reason why it was considered the most popular. But, the benefits available in it make it more attractive. Although the banks or post offices themselves explain the benefits of investing in PPF. But, there are many things in it which the investor is often not aware of. Be it interest or tax free investment or the amount received on maturity. This is an excellent investment tool in every respect. The maturity period is 15 years. But, the formula after 15 years does not make the money grow. Let us know what this formula is…

First understand the 3 situations. The biggest advantage of the scheme is that whether you invest money in it after maturity or not, interest will continue to be received. There are total 3 such options on maturity of PPF account. By choosing any of these options you can increase your money further.

1. You can withdraw the entire money after 15 years

On maturity of PPF account, withdraw the amount you deposited in it and the interest received on it. This is the first option. In case of account closure, your entire money will be transferred to your account. The special thing is that the money and interest received on maturity will be completely tax free. Also, you will not have to pay any tax on the number of years you have invested.

2. Increase investment in tenure of 5-5 years

The second advantage or option is that you can extend your account further on maturity. Account extension can be taken for tenure of 5-5 years. But, keep in mind that you will have to apply for extension only 1 year before the maturity of the PPF account. However, you can withdraw money during the extension. The rules of pre-mature withdrawal do not apply in this.

3. Increase PPF for 5 years without investment

The third biggest advantage of PPF account is that even if you do not choose the above two options, your account will continue to operate after maturity. It is not necessary that you invest in this. Maturity will automatically extend by 5 years. The good thing is that you will keep getting interest in it. Here also an extension of period of 5-5 years can be applicable.

Where to open PPF account?

PPF account can be opened in any government or private bank. Also, you can open an account in any post office of your city. Minors can also open an account, but the parents’ holding on their behalf will remain for 18 years. However, as per Finance Ministry rules, a Hindu Undivided Family (HUF) cannot open a PPF account.

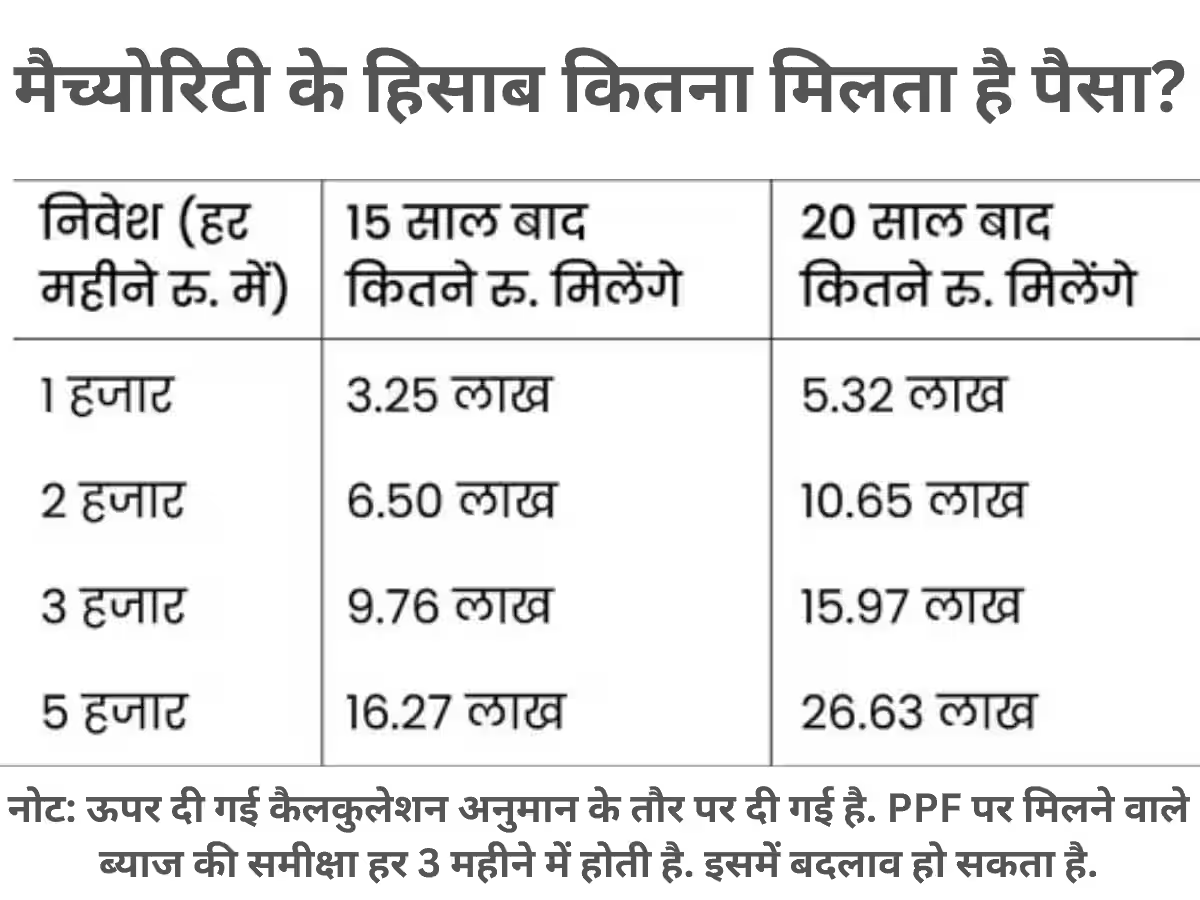

How will ₹1000 become ₹5.32 lakh?

At present 7.1 percent interest is being given in Public Provident Fund. If you invest for 15 or 20 years with this interest rate, you can create a huge fund.