Government has decided to extend the Senior Citizen Pension Plan, Pradhan Mantri Vyaya Vandana Yojana (PMVVY) till 31st March, 2023. Few revisions have been made to the scheme. PMVVY offers assured return of 7.4% for the Financial Year 2020-21. Rate of Return is to be reset on 1st April of every Financial Year.

The scheme was introduced in 2017. The maximum purchase price was fixed at Rs 7,50,000/- offering 8% return on the deposit. However, in the Union Budget for 2018-19, the maximum limit was enhanced to Rs 15,00,000/- (Rs 15 lacs). Return of 8% was offered on deposits made till 31st March, 2020. From FY 2020-21, the scheme has been further extended till 31st March, 2023. The interest rate is revised to 7.4% for FY 2020-21. It has been further decided that the rate would be reset at the beginning of every financial year, i.e, 1st April.

Life Insurance Corporation of India (LICI) has been given the sole authority to run the scheme.

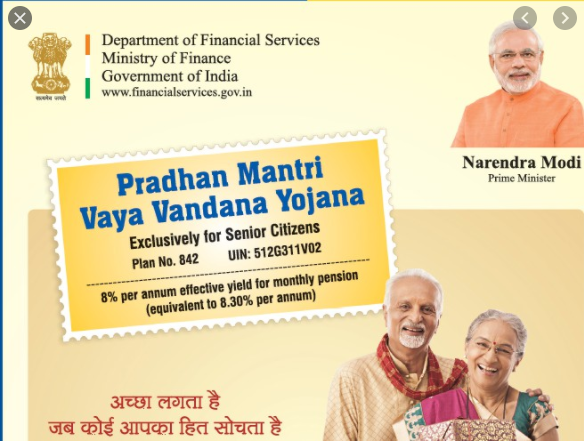

Pradhan Mantri Vyaya Vandana Yojana (PMVVY)

PMVVY is a social security scheme launched by the Government to provide financial security to the senior citizens. The scheme offers guaranteed return to the Senior Citizens under the scheme. The falling rate of interest in banks is a major cause of worry for the senior citizens. PMVVY aims to address the concerns of the senior citizens by offering reasonable return on the deposits.

PMVVY may be purchased online as well as offline. LIC portal allows Investors to purchase PMVVY online. In case, Individuals prefer purchasing the same offline, they may approach any of the preferred LIC branch office for the same.

Features of Pradhan Mantri Vyaya Vandana Yojana (PMVVY)

#Tenure of the scheme is 10 years.

#Minimum Purchase price under the scheme is Rs 1,56, 658/- and Maximum Purchase price is Rs 15,00,000/-.

#Policy may be purchased online through NEFT or RTGS transfer. Under offline mode, purchase may be made through cheque drawn in favour of LIC of India.

Also Read: Loan moratorium: relief to borrowers, Supreme Court gave these instructions to banks

#Senior Citizen may invest maximum of Rs 15,00,000/- ( Rs 15 lacs) under the scheme, aggregate of all the policies availed under the PMVVY.

#Minimum Pension under the scheme is Rs 1,000/- per month and Maximum Pension is Rs 9,250/- per month.

#Pension is paid out periodically, as opted by the Individual. Payment is done on Monthly, Quarterly (every 3 months), Half Yearly (every 6 months) or Yearly basis.

#Pension is paid through the NEFT Transfer or Aadhaar Enabled Payment System.

#PMVVY is not eligible for tax deduction U/S 80C of the Income Tax Act.

#Interest earned on the Deposit is taxable as per the existing tax laws, added to the Income of the Individual.

#Free Look in period is available 15 days if policy is purchased offline and 30 days in case the policy is purchased online.

Eligibility Criteria to Invest in the Scheme

#Minimum Entry Age: 60 Years

#Maximum Entry Age: No Limit

#Policy Terms: 10 years

#Maximum Investment: Rs 15,00,000/- (Rs 15 lacs)

#Minimum Investment: Rs 1, 56, 658/-

Benefits under Pradhan Mantri Vyaya Vandana Yojana (PMVVY)

#Regular Pension to the Individual during the policy tenure of 10 years, at the intervals opted for at time of availing the policy.

#Guaranteed Rate of Pension on the Investment, as per the rate decided at the beginning of every financial year.

#Interest Rate offered is comparatively higher than the return on Time Deposits offered by the Nationalized Banks.

#On death of the Pensioner during the policy term, the Purchase Price will be returned to the Nominee in full.

#On survival on the policy tenure, the Purchase amount along with final Pension amount will be paid to the Pensioner.

PMVVY Purchase Price & Pension

The purchase price has to be paid in lump sum. The pensioner needs to choose the Purchase Price or the Pension amount at the time of investment. Purchase price may be paid online through NEFT or RTGS transfer. For offline mode, the payment may be made through Cheque.

Mode of Pension Payment

Mode of Pension Payment is Monthly, Quarterly, Half Yearly and Yearly. Pension will be paid on completion of 1 month, 3 months, 6 months or 1 years, depending on the mode of pension opted by the Pensioner. The pension will be paid through NEFT transfer or Aadhaar Enabled Payment System.

The mode of pension once chosen cannot be altered later.

Tax Implications

Tax Deduction is not available on investment in the PMVVY. The pension amount is taxable under the Income Tax Act. The pension will clubbed with other sources of income of the Pensioner to determine the tax liability for the respective Financial Year.

Surrender of PMVVY Policy

Premature exit is permitted under exceptional circumstances during the policy tenure. Surrender of policy may be allowed on account of expenses related to the treatment of any critical/terminal illness suffered by the Pensioner or the Spouse. The Surrender Value payable under such circumstances is 98% of the purchase price.

Loan Facility

Loan against the policy is also available to the Pensioner post completion of 3 years of the policy. The maximum loan which may be granted is 75% of the purchase price.

The rate of interest on loan is determined at periodic intervals. Loan sanctioned till 30th April, 2021, the interest is levied at 9.5% p.a for the entire loan term.

Free Policy Look-in Period

PMVVY comes with free look-in period to enable Pensioners review the “terms & conditions” of the policy. The policy may be returned within 15 days from the policy date (30 days in case the policy is purchased online).

Pradhan Mantri Vyaya Vandana Yojana (PMVVY): Investment Review

PMVVY is a pension plan for the Senior Citizens. The policy offers guaranteed rate of return on investment for the policy tenure. In the current scenario, the falling rate of interest in Banks and uncertainty surrounding the Capital Market, PMVVY appears to be a secure option. The rate of return is marginally above the inflation rate which may not be sufficient in the long run. Even liquidity is an issue under the scheme, as withdrawal is possible only under exceptional cases. However, the return offered on PMVVY is higher compared to other risk free instruments so Senior Citizens may consider investing in PMVVY while planning for their retirement. The effective annual rate of return comes to 7.66% for FY 2020-21.

Interest Rate is to be revised every year. The revision in interest rate will be applicable for the new purchases only. Individuals buying the scheme in FY 2020-21 will earn assured return of 7.4% the entire tenure of the policy.

Revision in the rate of return is linked to interest earned on Senior Citizen Savings Scheme (SCSS) with maximum ceiling capped at 7.75%. Fresh appraisal of the scheme will be taken up on breach of the threshold limit.

Senior Citizens may diversify their funds between PMVVY, Senior Citizen Savings Scheme (offering similar return), Bonds and Time Deposits. Investment in Debt instruments will help Senior Citizens to earn higher return on the investments.