RBI: The Reserve Bank said that this step has been taken in view of the current financial condition of Shirpur Merchants Cooperative Bank. In this, no amount can be allowed to be withdrawn from the total balance in all the savings bank or current accounts or any other account of the depositor. However, bank customers will be able to repay the loan from the amount deposited in the account under these terms and conditions of the Reserve Bank.

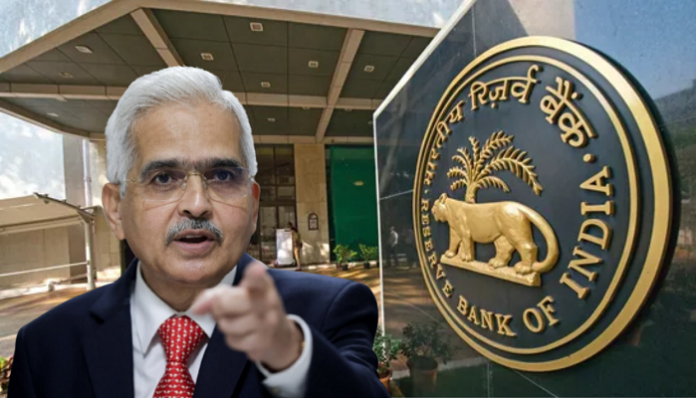

The matter of Reserve Bank of India’s action on Paytm Payments Bank has not yet completely cooled down that RBI has taken strict action against another bank. The Reserve Bank has taken strict action against Maharashtra-based Shirpur Merchants’ Co-operative Bank. In view of the deteriorating financial condition of the bank, the Central Bank on Monday imposed curbs on many services including withdrawal from accounts. Due to this, the customers of this bank may have to face problems.

The central bank said in a statement that after the close of business on Monday, this cooperative bank will not be able to give any new loan nor will it be able to make any investment. Along with this, the bank will also not be allowed to transfer or dispose of its property or assets without the prior permission of the Central Bank.

The Reserve Bank said that this step has been taken in view of the current financial condition of Shirpur Merchants Cooperative Bank. In this, no amount can be allowed to be withdrawn from the total balance in all the savings bank or current accounts or any other account of the depositor. However, bank customers will be able to repay the loan from the amount deposited in their account as per these terms and conditions of the Reserve Bank.

RBI said eligible depositors will be entitled to receive deposit insurance claim amount up to Rs 5 lakh from the Deposit Insurance and Credit Guarantee Corporation (DICGC).

The restrictions imposed on Shirpur Merchants Co-operative Bank from closure of business on April 8, 2024 will remain in force for six months.

However, the Reserve Bank said that these instructions should not be interpreted as cancellation of the license of the bank. It said the bank will continue to conduct banking business with these curbs until its financial position improves.