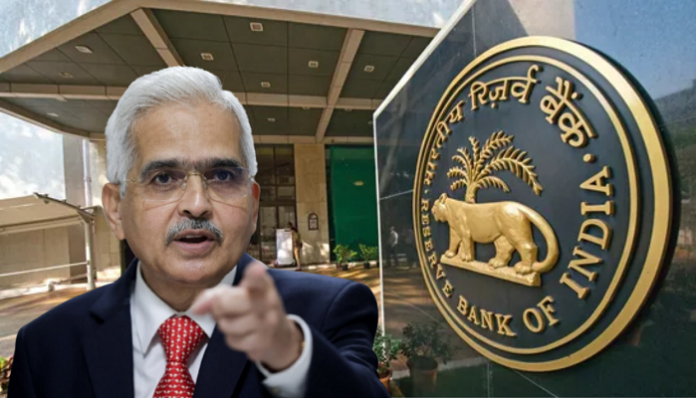

RBI has again taken action against banks. Due to violation of rules, fine was imposed on four banks and the license of a cooperative of UP has been cancelled.

RBI Action on Cooperative Banks: Reserve Bank of India (RBI) has taken strict action against five cooperative banks for violation of rules. Of these, the license of one bank in Uttar Pradesh has been cancelled. Also, fine has been imposed on four banks. RBI has canceled the license of Urban Cooperative Bank Limited located in Sitapur, Uttar Pradesh. According to RBI, the bank neither had enough capital left for operations, nor was there any hope of its earnings.

Fine on four cooperative banks

RBI has also imposed penalty on four cooperative banks. Among these, financial penalty has also been imposed on Rajarshi Shahu Cooperative Bank, Primary Teachers Cooperative Bank, Patan Cooperative Bank and District Central Bank. Of these, a fine of Rs 1 lakh each has been imposed on three and a fine of Rs 10,000 has been imposed on a cooperative bank. The central bank said that Rajarshi was not following the rules of minimum balance in the savings account. Teachers Co-operative Bank had sanctioned gold loans against the rules. Patan Cooperative was violating KYC norms and the District Central Bank failed to follow NABARD guidelines.

Why was the license of Urban Cooperative Bank canceled?

RBI said that Urban Cooperative Bank will have to close its operations from December 7 itself. The Commissioner and Registrar, Uttar Pradesh has also been requested to issue orders to close the bank and appoint a liquidator. According to RBI, the bank does not have sufficient capital or earning potential. Therefore, running of the bank is not good for the interests of its customers. The bank will fail to make full payments to its customers.

So many people will lose money

After cancellation of the license of Urban Cooperative Bank, up to Rs 5 lakh deposited in the account will be covered under insurance. Interest is also included in this. If the amount is more than this, it is not refunded. According to the data received from the bank, only 98.32 percent of its customers will be able to get their full money.