Nifty rose 218 points during the week closed at 10,331.6 and Sensex added 658.29 points closed at 33,626.97.

Indian markets remained highly volatile during the first week of the financial year 2019 amid global and domestic cues including RBI monetary policy and trade war worries between the world’s largest economies, US and China.

While the Reserve Bank of India maintained status-quo on rates, it cautioned against higher inflation trajectory in the coming months.

The Monetary Policy Committee (MPC) kept the policy repo rate unchanged at 6.0 percent and reverse repo rate at 5.75 percent, and the marginal standing facility (MSF) and the Bank rates at 6.25 percent.

The Nifty reacted positively to the MPC outcome and posted 2 percent gains to end at 10,325.15.

However, the US-China trade war worries kept Indian markets subdued during the week with both the indices shedding 1 percent on Wednesday.

On Friday, Nifty made a Doji type of pattern on the daily chart while a bullish candle for the weekly charts for the week ended 6 April. Nifty rose 218 points during the week closed at 10,331.6 and Sensex added 658.29 points closed at 33,626.97.

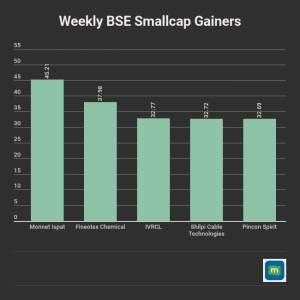

Foreign investors stayed net sellers, while domestic institutions were buyers in the last week. India’s volatility index (India VIX) shed 6.4 percent last week, while S&P BSE Smallcap index rose 5.2 percent, S&P BSE Midcap gained 4 percent and largecap index added 2 percent.

Auto index outperformed the other sectorial indices with 5.6 percent gain during the week.