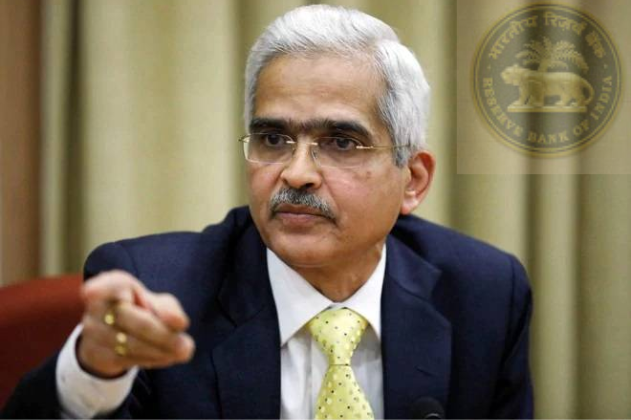

RBI recently banned these banks and ruled that customers will not be able to withdraw money from these banks for the next 6 months, which has shocked the customers. Who are these banks and why the ban was imposed, let us know

Reserve Bank of India (RBI) has taken a big decision regarding banks. If you also have a bank account, then this is useful news for you. RBI has taken strict action against 5 banks. Now the customers of these 5 banks will not be able to withdraw money. Along with this, many other restrictions have been imposed on these banks. Let us tell you that in view of the deteriorating economic condition of these banks, RBI has imposed restrictions on these banks. Let’s check which banks’ names are included in this list.

Can’t transfer money for the next 6 months

According to the statement issued by RBI, this ban on these banks will remain for the next 6 months i.e. the customers of the bank will not be able to withdraw money for the next 6 months. Along with this, these banks can neither approve loans nor make any kind of investment without giving prior information to RBI.

Many types of restrictions have been imposed,

let us tell you that now these banks do not even have the right to give any kind of loan. Apart from this, no new liability can be taken. Along with this, no transaction or any other use of any kind of property can be done.

These banks are included in the list

According to RBI, due to the current cash position of HCBL Sahakari Bank, Lucknow (Uttar Pradesh), Adarsh Mahila Nagari Sahakari Bank Limited, Aurangabad (Maharashtra) and Shimsha Sahakari Bank Regular, Maddur, Mandya (Karnataka), customers of these banks may withdraw money from their accounts. Will not be able to withdraw Rs.

Customers of these banks can do transactions up to Rs 5000

Explain that the customers of Urvakonda Co-operative Municipal Bank, Urvakonda (Anantpur district, Andhra Pradesh) and Shankarrao Mohite Patil Co-operative Bank, Akluj (Maharashtra) will be able to withdraw up to Rs 5,000.

Customers will get 5 lakh

RBI said that eligible depositors of the five co-operative banks will be entitled to receive deposit insurance claim amount up to Rs five lakh from the Deposit Insurance and Credit Guarantee Corporation.