The Reserve Bank of India (RBI) has limited the withdrawal limit for savings and current account customers of these two banks to Rs 5,000. This limit is for 6 months.

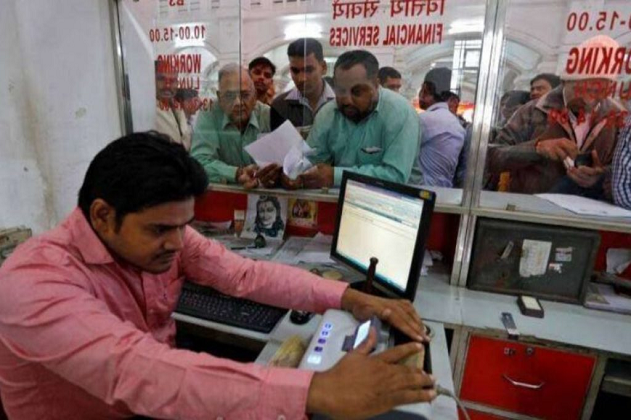

There is a bad news for the customers of two banks. The Reserve Bank of India (RBI) has limited the withdrawal limit for savings and current account customers of these banks to Rs 5,000. The Reserve Bank has taken this decision in view of the weak liquidity position of these banks. These banks are Uravakonda Co-operative Town Bank and Shankarrao Mohite Patil Sahakari Bank.

The ban will remain for the next six months

According to the Reserve Bank, this restriction will remain in force for a period of six months from the close of business on February 24, 2023, and will be reviewed by the RBI. The Reserve Bank has said in a statement that Uravakonda Co-operative Town Bank and Shankarrao Mohite Patil Sahakari Bank will not be able to grant or renew any loans and advances without prior approval of RBI. Banks will not be able to make any investment either. Both the banks will not be able to enter into any agreement and sell or transfer any of their properties or assets.

Banks will continue banking business with restrictions

The Reserve Bank has said in a circular, ‘Banks will continue banking business with restrictions till their financial position improves. The Reserve Bank may also consider modifications of these guidelines depending on the conditions. According to the Reserve Bank, eligible depositors will be entitled to receive deposit insurance claim amount up to Rs 5 lakh from the Deposit Insurance and Credit Guarantee Corporation on their deposits under the provisions of section 18A of the DICGC Act (Amendment) 2021.