Investors who don’t want to be part of this excessive fluctuation in the short term can use debt funds and fixed deposits as investment options.

The stock market has been volatile during recent days. If you are a risk-averse investor, you should invest a portion of your money in fixed income avenues including fixed deposits and debt funds.

“Investors who don’t want to be part of this excessive fluctuation in the short term can use debt funds and fixed deposits as an investment instrument.

“Investing in these assets will give them a cushion against these rough patches as these investments offer a fixed return. Yes, these instruments also play an important role in the process of financial planning, depending on the investor’s attributes, i.e risk appetite, investment horizon and goal and investment conditions. These instruments help in reducing the risk of the overall portfolio and can be used to reduce the overall beta of the portfolio,” Abhinav Angirish- Founder investonline Pvt Ltd. said.

However, choosing the right debt fund could be difficult given a large number of offerings in the market. Also, fixed deposit rates vary from bank to bank and one should try and find the best deal possible. Moneycontrol asked Naveen Kukreja CEO & Co-founder, Paisabazaar.com to identify his best picks in each category.

Here are his recommendations based on in-house research:

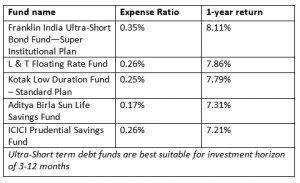

Top Ultra-short term debt fund (Direct plans)

Top Short-term debt funds (direct plans)

Here are Kukreja’s some good picks related to fixed deposits to make investments.

Top FD rates offered by small finance banks

Top FD rates offered by major banks

Top FD rates offered by other banks

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com