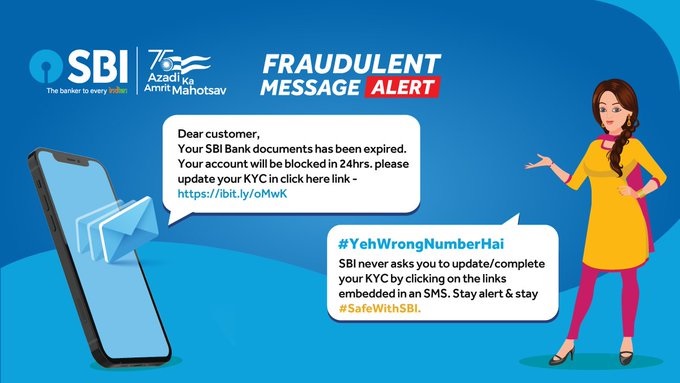

SBI has told how you can become a victim of fraud through SMS or mail in the name of KYC and your deposits can disappear in a jiffy.

new Delhi. The cases of banking fraud are increasing continuously in the country. These frauds are making people a victim of their fraud in new ways. To avoid such frauds, the country’s largest bank State Bank of India has been continuously warning people. In this sequence, SBI has issued another tweet warning its crores of customers of KYC fraud. The bank has told how you can become a victim of fraud through SMS or mail in the name of KYC and your deposits can disappear in a jiffy.

SBI has tweeted and said that if any link comes to a customer through SMS, then do not click on it even by forgetting. This mistake can cost them heavily and the entire money can be withdrawn from their account.

Here is an example of #YehWrongNumberHai, KYC fraud. Such SMS can lead to a fraud, and you can lose your savings. Do not click on embedded links. Check for the correct short code of SBI on receiving an SMS. Stay alert and stay #SafeWithSBI.#SBI #AmritMahotsav pic.twitter.com/z1goSyhGXq

— State Bank of India (@TheOfficialSBI) March 4, 2022

The bank has also asked the customers to take special care about the SMS they receive in the name of SBI. The bank has alerted that think many times before hastily clicking on any unknown or unknown source link, otherwise your bank account will be empty in a moment.

SBI tweeted from its official handle, “Here is an example of #YehWrongNumberHai, KYC fraud. Such SMS can lead to fraud and you can lose your savings. Do not click on embedded links. On receiving the SMS, check the correct short code of SBI. Stay alert & stay #SafeWithSBI”