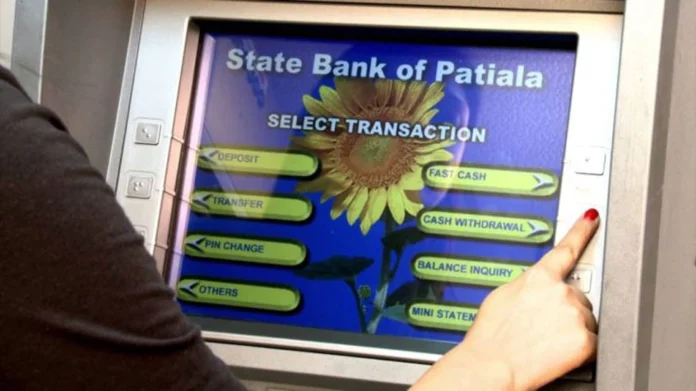

Fraud from ATMs has increased a lot in today’s time. But if you are a State Bank of India customer then you can stop this fraud by using OTP facility. In this way, you can take advantage of this facility.

In view of the increasing fraud in today’s time, State Bank of India (SBI) is giving its customers the facility to withdraw cash through OTP. This means that along with the ATM PIN, customers will also have to write OTP. Only after that you will be able to withdraw money from ATM. The bank is making such changes to make ATM transactions more secure.

State Bank of India (SBI ATM) customers can avail this facility at the time of cash withdrawal of 10 thousand or more. Where another OTP will also have to be written along with the PIN of the debit card. Let us tell you, this is not a new facility, it was started on January 1, 2022 only. Let us know how this system works-

How SBI OTP System Works

1- To withdraw money from the ATM, an OTP will be sent to your registered mobile number from the bank.

2- This will be a four-digit OTP, which will be used by the customer only once.

3- Once you will see your amount and proceed in the process of withdrawing money then you will see the option to write OTP.

4- Enter the OTP received on your mobile, after which your transaction will be completed.

Our OTP based cash withdrawal system for transactions at SBI ATMs is vaccination against fraudsters. Protecting you from frauds will always be our topmost priority.#ATM #OTP #SafeWithSBI #TransactSafely #SBIATM #Withdrawal #AmritMahotsav #AzadiKaAmritMahotsavWithSBI pic.twitter.com/g5P50lFhLw

— State Bank of India (@TheOfficialSBI) April 9, 2022