FD Rate: SBI increased interest rates by 65 basis points while RBI increased the repo rate by only 35 basis points. Banks are facing shortage of cash, due to which there has been such an increase.

SBI Hikes FD Rates: Now you will get more interest on getting FD in banks. The country’s largest public sector bank SBI has announced an increase in the interest rates of fixed deposits of different tenures. SBI has increased the interest rates on FDs from 15 basis points to 65 basis points, which has come into effect from today, December 13, 2022.

Will get more interest on FD

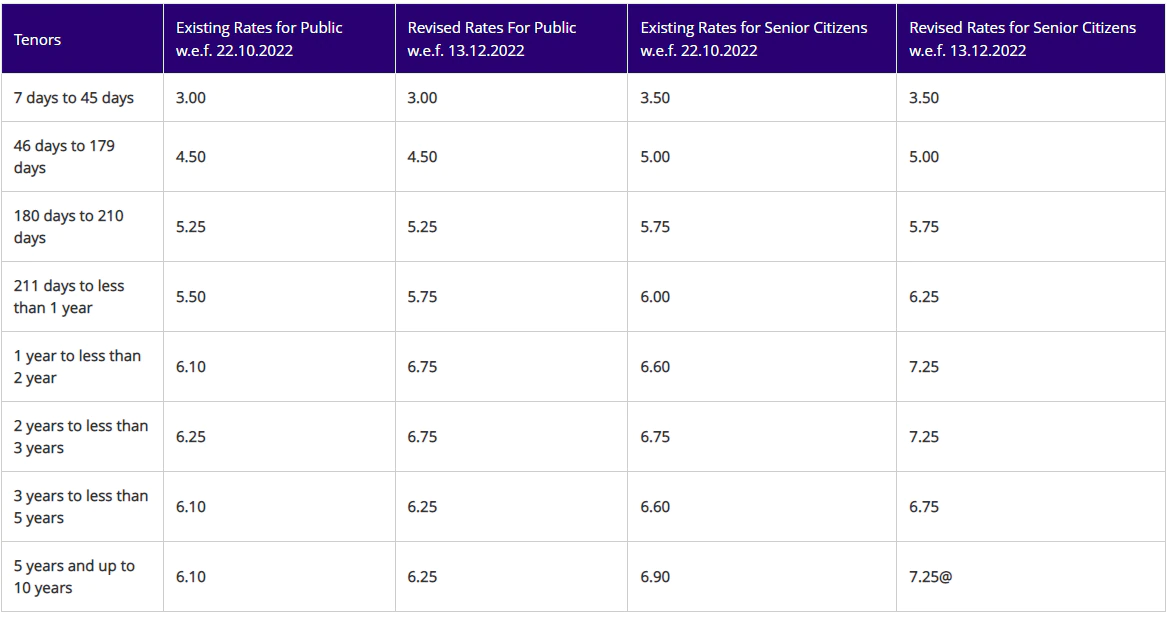

SBI has increased the interest rates on fixed deposits up to Rs 2 crore. Now 5.75 percent interest will be available on FDs with a period of 211 days to 1 year, which used to get 5.50 percent earlier. On the other hand, 65 basis points more i.e. 6.75 percent interest will be available on FDs of one year to less than two years, which used to get 6.10 percent earlier. 6.75 percent interest will be given on fixed deposits of less than 2 years to 3 years, which used to get 6.25 percent earlier. However, only 15 basis point interest rates have been increased on FDs with tenures of 3 to 5 years and 5 to 10 years. Earlier 6.10 percent interest was available on FDs of both the periods, which will now get 6.25 percent interest. That is, only 15 basis point interest rates have been increased.

Interest rates on SBI Wecare Deposit also increased

SBI has also increased the interest rates on SBI Wecare Deposit, a special fixed deposit scheme for senior citizens. Now 7.25 percent interest will be given on FDs above 5 years and less than 10 years. Under this scheme, in addition to 50 basis points more interest given to senior citizens, there is a provision to pay 50 basis points more interest i.e. the total is 1 percent more. SBI Wecare Deposit scheme has been extended till 31 March 2023.

FD rate hike after repo rate hike

On 8 December 2022, RBI decided to increase the repo rate for the fifth consecutive time. Since then speculations were being made that government as well as private banks would increase the interest rates on FDs. RBI has increased the repo rate by only 35 basis points but SBI has decided to increase FD rates by 65 basis points. Actually banks are facing cash crunch. In such a situation, banks are increasing interest so much to woo investors and depositors.