Foreign institutional investors pulled out more than Rs 8,000 crore from equity markets, and over Rs 17,000 crore from the India debt market which kept the pressure on the rupee.

he age-old saying ‘sell in May and go away’, which in fact was more relevant for US markets came true for Indian markets in 2018. The Nifty50 closed flat for the month of May but with a negative bias while three out of four stocks gave negative returns.

The Nifty50 slipped marginally to 10,736.15 on May 31 from 10,739.35 registered on April 30, although, the index managed to recover over 300 points from intraday low of 10,417.80 recorded on May 23.

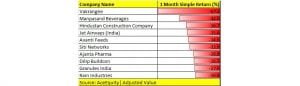

As many as 376 stocks from the S&P BSE 500 index gave negative returns in the month of May which fell up to as much as 67 percent. Stocks which witnessed selling pressure include names like Vakrangee (down 67 percent), Manpasand Beverages (down 44 percent), HCC (down 36 percent), Jet Airways (down 35 percent), Avanti Feeds (down 34 percent) etc. among others.

Shareholders of Vakrangee and Manpasand might have more than just a price fall to worry about. Stocks of both companies witnessed tremendous selling pressure after auditors of both the companies resigned ahead of quarterly results.

On April 27, Price Waterhouse & Co resigned as auditor of Vakrangee Ltd, and on May 26, Deloitte Haskins & Sells resigned as auditor of Manpasand Beverages Ltd.

HCC came under pressure after auditor of the company’s unit Lavasa Corp had said on Wednesday it has “significant doubts about the company’s ability to continue as a going concern”. The news came out in the first week of May.

What led to the fall, and way ahead?

Trade war concerns between US and China, political uncertainty in Karnataka, rising crude oil prices, falling rupee against the dollar, disappointing results especially from public sector banks as well as relentless selling by foreign institutional investors (FIIs).

Foreign institutional investors pulled out more than Rs 8,000 crore from equity markets, and over Rs 17,000 crore from the India debt market which kept the pressure on the rupee.

Well, as we enter June, there are plenty of headwinds for Indian markets. For starters, we have Reserve Bank of India (RBI) policy meet in this week, followed by US Fed meeting on June 12-13 will keep investors across the globe on the edge. A rate hike by the central bank seems to be factored in by the markets, suggest experts.

“Markets were fairly volatile during last week on renewed trade war worries and continued FII selling despite Q4FY18 GDP growth coming in at 7.7 percent. Going ahead the focus of the market globally will be on Fed rate hikes, bond yields, oil prices, and trade war tensions,” Teena Virmani, Vice President – Research at Kotak Securities Ltd told Moneycontrol.

“June US Fed rate hike is already factored in by markets but it is important to watch out as to how many rate hikes are expected for CY18. Domestically, RBI policy and its outcome on rates is eyed closely due to the impact of higher fuel prices, expected an increase in MSP on inflation and improved growth prospects for the economy,” she said.

Technically:

On the weekly and monthly charts, Nifty made an indecisive pattern ‘Spinning Top’ was witnessed on the weekly charts whereas on the monthly charts it registered a Doji kind of formation. April was a strong month whereas in May we haven’t made any progress.

For the month of June, most experts feel that the index is likely to consolidate in a range rather than seeing any big moves on either side. On the upside 10,777, 10,929 remains a crucial resistance to watch out for and on the downside, support is placed at 10,417.

“Going forward, our best case scenario for June still remains sideways to negative based on our long-term trend projections. As we have been pointing out that we are in a multi-month corrective phase from the highs of 11,171, it seems that the pullback rally from the lows of 9,951 culminated at recent highs of 10,929,” Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

“According to the Elliot wave parlance, the triangular structure will unfold in 5 legs and it seems that second leg culminated at the recent high of 10,929. If our reading is right then going forward we should breach recent lows of 10,417 and may extend the correction up to 10,320 to culminate the third leg,” he said.