SIP Calculator: Leave excuses and invest. Its habit will make you money. Whether the salary is low or high, only the consistency of investment will lead you to the goal and help in creating a huge fund.

Investment in thousands and earning in crores… It sounds strange but it is easy to make reality. Many people dream of becoming a millionaire, but only those who understand the nuances of investment can make it a reality. Investing is easy, but to reach your target, it is important to know where and how much to invest. If you work with the right direction and strategy, you will definitely become a millionaire in time. For this, it is also necessary to have coordination of age. There is no shortcut way to become a millionaire. There is only one way to make money from money. Whether the salary is low or high, only the consistency of investment will lead you to the goal and help in creating a huge fund.

You can invest even with a small amount, not big.

There is no need of huge amount for investment. A big fund can be created even with a small amount. Every month you have to choose how much money to save daily and invest it regularly. You must have often seen in advertisements that mutual funds are right. But, how much is right for whom depends on the continuity of your investment. Understand the power of SIP and travel up to Rs 1 crore by saving Rs 100 daily. For this a

trick has to be used.

Saving of only 100 rupees will give more than 1 crore

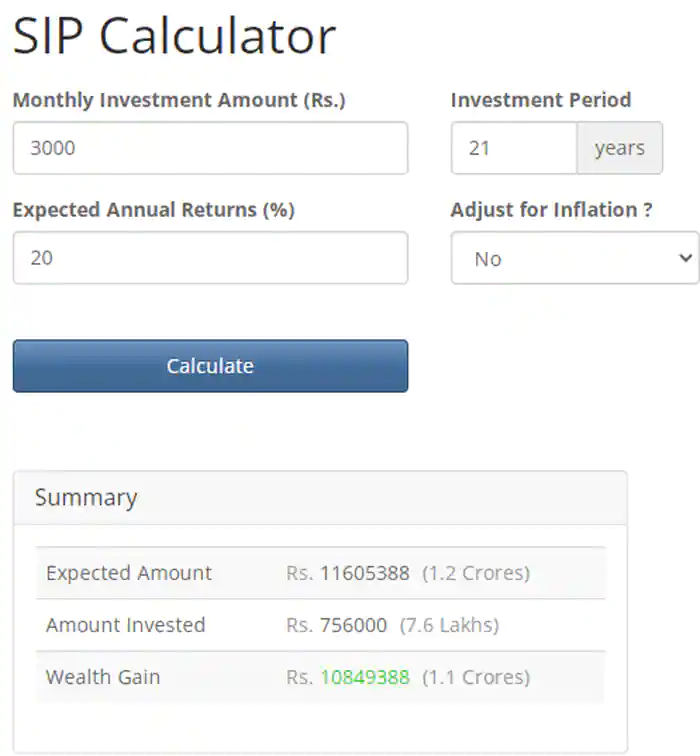

Make a habit of investing Rs 3000 in mutual funds every month through Systematic Investment Plan (SIP). Means you have to save 100 rupees daily. Invest this money for 21 years. Means you have to invest monthly for a total of 250 months. Mutual funds have given strong returns in the long term. There are many funds which have given returns of up to 20% and look very good for further earnings. Do a complete study before choosing funds. If there is a financial planner, invest only on his advice.

How to become Rs 1 crore from Rs 100 in 250 months

Suppose you save 100 rupees daily, then this amount will be 3000 rupees in a month. Invest it in mutual funds through SIP. Assuming 20% annual return, you will have Rs 1,16,05,388 (1.2 Crores) in 21 years. It is to be noted here that during 21 years you have invested only Rs.7,56,000. The remaining Rs.1,08,49,388 (1.1 Crores) is your wealth gain. Means compounding has given tremendous advantage here.

How much will be the income with inflation?

Keep in mind that this calculation has been done only as an estimate. If we look at inflation for 21 years as well, then the figures will be different. Suppose you started investing with Rs 3000 and got 20% annual return, then you will have Rs 45,77,647 (45.8 Lakhs). The investment amount will remain the same at Rs 7,56,000 (7.6 Lakhs) and the wealth gain will be Rs 38,21,647 (38.2 Lakhs). Here the annual inflation rate has been taken as 6%. Due to this your investment amount has been adjusted.