How to become Crorepati: First of all- The younger you start investing, the bigger your amount you will be able to generate in the future. However, becoming a millionaire is not easy.

How to become Crorepati: Earning money is easy, but it is equally difficult to grow. Keep your money safe and keep giving good returns. Finding such an instrument is not difficult. Start investing and see the wonders. But, if the decision goes wrong, the money will not grow as fast. That’s why it is important to do proper planning and know where to get the benefit. First things first- The younger you start investing, the bigger your amount you will be able to create in the future. However, becoming a millionaire is not easy. But, if you invest a fixed amount for a long period, then you can also become a millionaire. The formula of compounding works behind this. The simple formula of Power of Compounding is that the investment should be long term.

Power of compounding

– Interest on original investment

– Re-interest benefit on both the amounts

– Investment + Interest + Interest + Interest = Compounding

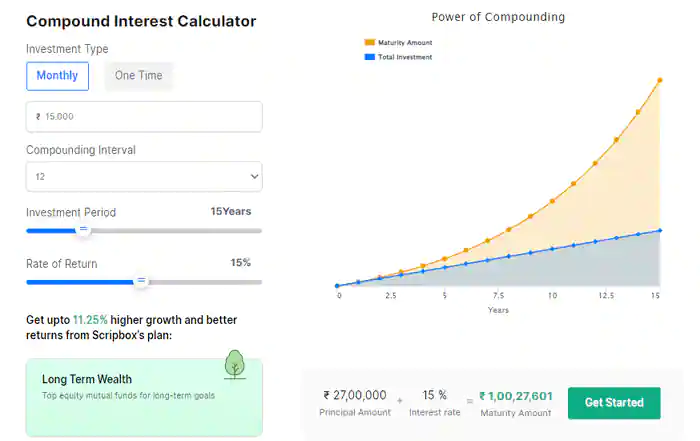

Apply 15x15x15 formula and make money?

- Investment – Rs 15,000

- Tenure – 15 years

- Interest – 15%

- Corpus – After 15 years Rs 1 crore

- Total investment – Rs 27 lakh

- Compounding – 73 lakh interest earned

Will have to invest for 20 years

If you do monthly SIP with mutual funds. Start it with 10 thousand rupees. Generally, returns in mutual funds can be up to 12 percent. Here you have to invest up to 20. Your total investment in 20 years will be Rs 24 lakh. But, the interest that will be available on this will be Rs 74.93 thousand. Meaning here the power of compounding worked. The total value of the SIP will reach Rs 98.93 lakh. You earned only interest of total 74.93 lakh rupees.

What is Power of Compounding?

It can be understood in such a way that the earnings that you earn on investing somewhere, it is also compounding to reinvest it. In this, you get interest on the principal along with its interest. Where compounding is a great way to increase your investment.

Note: The above calculation is made as an estimate. Please consult a financial advisor before making any kind of investment.