SIP Calculator: If you want to become a millionaire, then you will have to spend some money i.e. invest. There is no product or instrument to be purchased in this. Neither have to invest in the stock market.

SIP Calculator: Money is made from money itself. If you want to become a millionaire, then some money will have to be spent. There is no product or instrument to be purchased in this. Neither have to invest in the stock market. Rather, make a large corpus by making small investments through mutual funds. SIP is one such tool, through which the goal of becoming a millionaire can be achieved in the long run. The advantage of investing in the long term is because, it can earn huge returns through compounding. If you start investing at the right age, you can become a millionaire even 15 years before retirement. The most important thing is that it has maximum Wealth Gain.

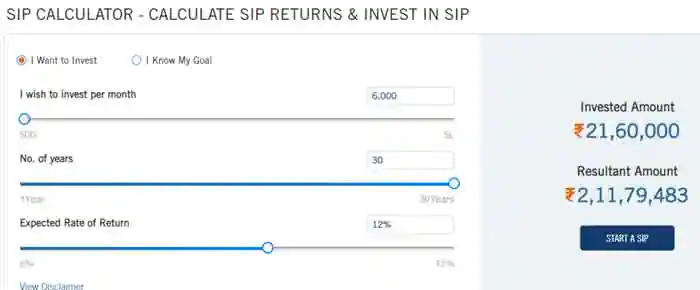

Calculate Your Wealth Gain With SIP Calculator

- Suppose investment age – 20 years

- Investment period – 25 years Investment –

- Rs 6000 per month

- Average return – 12%

- 45 years age – Funds above Rs 1 crore

- As per SIP calculator, invest Rs 6,000 per month and annually If the average return is 12%, then in 25 years a fund of Rs 1 crore 13 lakh 85 thousand 811 can be ready. In this, your total investment in 25 years will be Rs 18 lakh. At the same time, there will be a return of 95 lakh 85 thousand, 811 rupees i.e. wealth gain.

Will get more than Rs 2 crore in 30 years

If the period of investment is increased by 5 years. The total investment for 30 years will be Rs 21,60,000. At the age of 50, you will have an amount of Rs 2,11,79,483 crore ready. Inflation has not been adjusted for in the calculation.

Decide on income, target, risk profile

SIP is a systematic method of investment. There are many such funds which have given annual returns of 12% over the long term. In this, the investor does not have to face the risk of the market directly. At the same time, the returns are also higher than the traditional product. Keep in mind that investing in mutual funds is subject to market risks. Therefore, the investor should decide only after looking at the income, target and risk profile. Through SIP, you can easily find out the investment habit, risk and the assessment of the return on it.