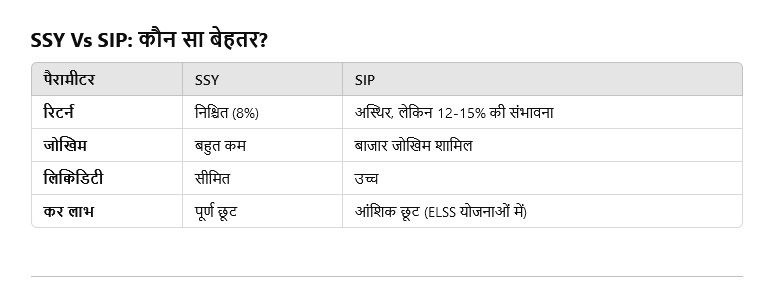

SSY Vs SIP: For investors who want to avoid risk and want guaranteed returns for their daughter, Sukanya Samriddhi Yojana is a safe option. On the other hand, if investors are ready to invest for a long time and have the possibility of better returns, then SIP may be better for you.

SSY Vs SIP: Financial planning for the future of a daughter is the priority of every parent. The two main investment options Sukanya Samriddhi Yojana (SSY) and Systematic Investment Plan (SIP) are most discussed. Both these schemes have their own advantages and limitations. Let’s compare them and find out which option is better for your daughter’s future.

Sukanya Samriddhi Yojana (SSY)

Sukanya Samriddhi Yojana is a savings scheme launched by the government. It is specially designed to secure the future of daughters.

Features of Sukanya Samriddhi Yojana

- Interest Rate: Currently SSY offers around 8% annual interest, which is higher than other savings schemes.

- Tax Benefits: Both the investment and maturity amount are completely tax-free.

- Investment Range: Minimum Rs 250 and maximum Rs 1.5 lakh can be invested per year.

- Lock-in Period: The account matures when the daughter turns 21 years old, however partial withdrawal is allowed at the time of marriage.

Benefits of Sukanya Samriddhi Yojana

- Non-risky investment: This is a completely government guaranteed scheme.

- Long Term Planning: It helps in providing financial assistance for daughter’s higher education or marriage.

- Limitations of Sukanya Samriddhi Yojana

- Lack of liquidity: Limited partial withdrawals are allowed if needed.

Possibility of low returns: When inflation rate is high in the long term, its returns may be lower than SIP.

Systematic Investment Plan (SIP)

SIP is a method in which a fixed amount is invested in mutual funds at regular intervals.

Key features of SIP

- Return Potential: Historically mutual funds have given annual returns of up to 12-15%.

- Flexibility: It is up to the investor to decide the investment amount and tenure.

- Liquidity: Investments in SIP can be redeemed any time as and when required.

Benefits of SIP

- Inflation-beating potential: SIP has the potential to deliver above-inflation returns in long term investments.

- Flexibility: In this you can increase or decrease the investment according to your need and financial goal.

Limitations of SIP

- Market Risk: Returns depend on market conditions.

- No Guarantee: There is no guarantee of fixed returns.

Most Read Articles:

- Income Tax Savings : Senior citizens can increase their tax savings through these exemptions, know how

- Jio Cheapest Recharge Plans: You will get daily data and free calling under Rs 250, check plans details

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide

- Advertisement -DISCLAIMER

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com