Investors are advised to stay with quality stocks and especially those which have reported strong numbers in the March quarter

The S&P BSE Sensex rallied over 600 points or by about 1.7 percent for the week ended May 11 but is still short a little over 900 points short of its all-time high of 36,443.98, but over 100 stocks hit fresh record highs in May.

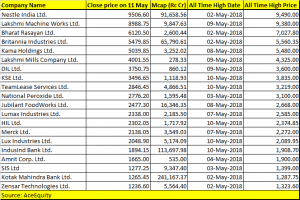

As many as 117 stocks have hit fresh record highs so far in the month of May, which include names like Nestle India, Lakshmi Mills Company, TeamLease Services, Jubilant FoodWorks, IndusInd Bank, Kotak Mahindra Bank, MindTree, Raymond, Escorts, M&M, Dewan Housing Finance, Indiabulls Ventures, Hexaware Technologies, Berger Paints etc. among others.

Out of 117 stocks which rose to their fresh record highs, 44 stocks hit fresh record highs on Friday. The list includes names like KSE, Lux Industries, Khadim India, Future Lifestyle, Take Solutions, Mahindra Logistics, Nath Bio-Genes (India), HIL etc. among others.

Most of the small and midcaps saw some buying interest, which pushed the price for select stocks towards fresh record highs. Investors are advised to stay with quality stocks and especially those which have reported strong numbers in the March quarter.

“In the recent past, accumulation and buying interest at lower levels have been seen in some of the quality midcap and smallcap stocks,” Rajesh Palviya, Head – Technical & Derivatives Analyst, Axis Securities told Moneycontrol.

“We believe that stocks with good fundamentals backed by a good set of number in Q4FY18 results would continue to rally as the benchmark index is in bullish zone,” he said.

The momentum is seen in the broader market despite some sharp profit booking seen in that space. The S&P BSE midcap index slipped 1.3 percent while the S&P BSE Smallcap index slipped nearly 1 percent in the same period.

Analysts advise investors to stay with stocks which are witnessing momentum. As many as 178 stocks on the BSE hit a fresh 52-weeks high which include names like Britannia Industries, TCS, Pfizer, Zensar Technologies, Divi’s Laboratories, Quess Corp, MindTree, Escorts, Dabur India, Parag Milk, Exide Industries, Ashok Leyland etc. among others.

“Considering the stock specific destruction in the week gone by, traders need to be very agile when it comes to stock picking. In the initial part of the forthcoming week, it is advisable to stay light and keep assessing how the market behaves for a day or two post the key political event,” Sameet Chavan, Chief Analyst, Technicals and Derivatives at Angel Broking told Moneycontrol.

“It is possible for stocks which are witnessing momentum to trend higher, but at the same time, it’s also advisable to keep booking timely profits and trailing of stop losses in order to safeguard your notional profits,” he said.

The outcome of Karnataka assembly election will set the market tone. Any majority win for Narendar Modi led-Bharatiya Janata Party will increase investors’ confidence and we could see the markets moving towards a new high in the coming week, suggest experts.