Tata Steel helped Bhushan to swiftly gain its lost production.

Ever since Tata Steel acquired Bhushan Steel through the insolvency process, investors have been eagerly waiting for the turnaround of its operation. The company, now named as Tata Steel BSL, reported its first annual results after the acquisition. The marked improvement in its sales and profitability is worth noting particularly in the light of its impact on Tata Steel’s consolidated performance.

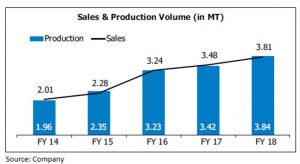

First and foremost, the company has been putting a lot of efforts in ramping up the production and increasing utilisations. A 20 percent year-on-year increase in sales during the quarter ended in March 2019 and a 19 percent YoY growth in annual sales are clear indications of higher production.

This certainly indicates that volumes have increased as a result of higher production. This is good news for Tata Steel and reflects in its overall growth in domestic volumes. During FY19, Tata Steel has reported 34.5 percent growth in its annual steel production to 16.79 million tonne. This is after accounting for the production of close to 4.2 million tonnes of Bhushan Steel. Tata Steel has helped Bhushan to swiftly gain its lost production.

Operating gains

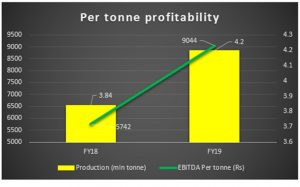

During the financial year 2019, Tata Steel BSL produced 4.2 million tonne of steel, which is a growth of 9.37 percent as against an annual production of 3.8 million tonnes in the financial year 2018.

What is interesting is the improvement in the profitability. During the year ended in FY19, the company’s EBIDTA worked out to close to Rs 9,044 per tonne as against Rs 5,742 per tonne in the fiscal 2018. This is a huge improvement and reflects benefits of scale and cost-saving measures undertaken by Tata Steel.

This is also critical for the profitability of Tata Steel and a positive contribution to the group profitability. During the quarter, Tata Steel BSL reported a net loss of Rs 212.4 crore, significantly lower compared to the Rs 21,252-crore loss in the similar quarter last year and the Rs 240-crore loss in the December quarter.

Outlook

Tata Steel’s domestic business earned an EBIDTA of Rs 16,240 per tonne in Q3FY19. Since the product profile of Bhushan is far superior, the expectations is that, going forward, the profitability should improve further to about Rs 11,000 a tonne in the near term.

This, along with the further scope for volumes growth, will make sure that the company should be profitable possibly by the end of the first half of the current financial year. In terms of the stock, however, we believe that it would be better to own Tata Steel than Tata Steel BSL as, considering the structure of the deal, any turnaround in the business would largely benefit Tata Steel.