Rishi Narang’s salary is not very tax friendly. More than 15% of his income is swallowed by tax. Taxspanner estimates that his tax can be reduced by over Rs 65,000 if his company offers him a few tax-free allowances and the NPS benefit.

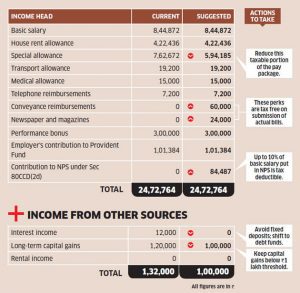

Narang gets a few tax-free allowances. If his company also offers him conveyance and newspaper reimbursements of up to Rs 84,000, his tax will come down by almost Rs 26,000. The special allowance, which is taxable, can be reduced to make place for these two reimbursements in the total cost-to-company.

Income from employer

Next, he should ask his company to put 10% of his basic salary in the NPS under Section 80CCD(2d). This will reduce his tax by another Rs 26,000.

Narang and his wife and their three-month-old daughter are covered by the group medical cover provided by their employers. But his senior citizen parents are not covered by these group policies. Narang should buy medical insurance for them. A premium of Rs 35,000 will reduce his tax by about Rs 11,000.

An avid investor, Narang puts Rs 25,000 a month in a clutch of mutual funds. But he also has fixed deposits that earn an interest of about Rs 12,000. Instead of fixed deposits, Narang should consider investing in debt funds where the tax rate is significantly lower if the investment is held for more than three years. He will save almost Rs 2,500 in tax this way.

Write to us for help

Paying too much tax? Write to us at etwealth@ timesgroup.com with ‘Optimise my tax’ as the subject. Our experts will tell you how to reduce your tax by rejigging your pay and investments.

Disclaimer: The opinions expressed in this column are that of the writer. The facts and opinions expressed here do not reflect the views of www.economictimes.com