How to Check TDS Status: You can check the status of Tax Deducted Source (TDS) online. TDS is a tax collection process implemented under the Income Tax Act 1961. Under this process, the government first gets a fixed part of the tax. TDS is deducted from some percentage of the total amount.

How to Check TDS Status: You can check the status of Tax Deducted Source (TDS) online. TDS is a tax collection process implemented under the Income Tax Act 1961. Under this process, the government first gets a fixed part of the tax. TDS is deducted from some percentage of the total amount. The monitoring of this tax comes under the Central Board of Direct Taxes (CBDT). Many times taxpayers need to check their TDS status so that they can know the status of their tax payment. So that, they can avoid any kind of trouble while submitting income tax return. Here we are telling you how to check TDS status through PAN card, Form 26AS and other ways.

What is TDS return?

TDS return is a quarterly financial status, which taxpayers have to submit to the Income Tax Department. This return includes the PAN number of the deductor, information about tax payment made to the government, TDS challan and other information.

How to check TDS status with PAN card?

If you want to know the TDS status through your PAN card, then follow the steps given below.

- Go to the official website.

- Enter the verification code.

- Click on Proceed.

- Enter PAN and TAN number.

- Select the financial year, quarter and type of return.

- Click on Go.

- Your TDS details will appear on the screen.

How to check TDS credit through Form 26AS?

To check TDS status through Form 26AS, follow the steps given below:

- Go to the Income Tax e-filing portal.

- If not already registered, register.

- After logging in, click on the My Account tab.

- Select the option of View Form 26AS.

- Select the Financial Year and PDF format.

- Download the form.

- This file will be password-protected, to open it, enter the date of birth given in the PAN card.

- Apart from this, TDS information can also be seen from the net banking portal, but for this PAN must be linked to net banking.

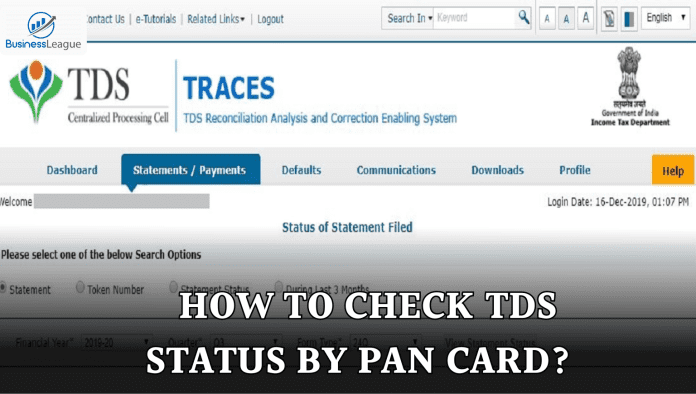

How to check TDS through TDSCPC portal?

TDS status can also be checked with the help of TDS Central Processing Cell (CPC). For this, follow the steps given below.

- Go to the TDSCPC portal.

- Click on the Taxpayer tab.

- Select View TDS/TCS Certificate option.

- Enter the Verification Code.

- Fill in the PAN number of the taxpayer and other required details.

- Click on Go.

- Your TDS details will appear on the screen.

How to view TDS from Income Tax e-Filing Portal?

- Login to the Income Tax e-Filing portal.

- Click on the My Account tab and select View Form 26AS.

- You will be redirected to the TRACES portal.

- Select the Assessment Year and file format.

- Your TDS details will appear on the screen.

Most Read Articles:

- SBI Recruitment 2025: Bumper recruitment in SBI without exam, will get salary more than 1 lakh, know selection & other details

- PGCIL Recruitment 2025: Golden chance to get job on these post in PGCIL, salary is in lakhs, know selection & other details

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide