The missing insurance component in a mutual fund investment can be compensated by purchasing a term insurance of the same amount.

Many investors choose to invest in equity-oriented mutual funds because of the high returns offered. On the other hand, Unit Linked Investment Plans (ULIPs) also offer returns linked to the stock market, along with a portion of premium allocated towards life insurance cover.

The missing insurance component in a mutual fund investment can be compensated by purchasing a term insurance cover of the same amount which comes at an affordable premium. If one does match the insurance coverage through a term plan, do mutual funds along with it work out a better investment option than buying a ULIP with similar insurance benefits? Opinion among financial advisors seems to differ on the issue.

Taxation and Cost of Product

“In our view, a combination of term insurance and mutual funds trumps ULIPs. Besides the mortality costs that are more or less at par with the cost of buying a similar quantum of term insurance, ULIP’s have a host of charges such as fund management charges, premium allocation charges and policy administration charges embedded into them,” said Mayank Bhatnagar, COO, FinEdge.

However, the 10 percent of Long Term Capital Gain (LTCG) reintroduced in this budget, which is going to be applied to profits in excess of Rs. 100,000 earned either from stocks or equity-based mutual funds – may see some investors to change their idea of investing their money into Unit Linked Insurance Plans (ULIPs) instead of mutual funds.

Anil Rego, CEO – Right Horizons said that the cost of a financial product is an important parameter because even superlative returns can be negated with prohibitively high expenses. At the present juncture, there are some ULIPs which have cost structures that are lower than regular mutual funds and even compete with direct options of the funds. “Given that ULIPs, especially in the large-cap space, has delivered returns matching category averages of large-cap funds in the 5 or 10-year time frame, clearly some ULIPs do seem a better option. Their offering becomes sweeter than MFs on account of added insurance and tax benefits,” he said.

Switch Option Availability

Manik Nangia- Director Marketing and Chief Digital Officer, Max Life Insurance said that Unit Linked Insurance Plans don’t just offer a professionally managed investment cum protection platform, but also provide an entry to an ever-attractive equity market. ULIPs offer you an array of fund options to invest your premiums ranging from 100% debt to 100% equity. “Unit Linked plans offer flexibility and freedom to rebalance one’s portfolio by moving their investments from one fund to another, within one plan. One may transfer units fully or partially between fund options available- equity, debt or balanced fund options. You can maximize your returns from ULIPs by smart use of the switching features to leverage changes in the market,” he said.

However, while investing money in pure debt or equity mutual fund schemes, you can still use the switching option within the funds of the same AMC and you can transfer your money from one scheme to any of the other debt or equity mutual funds very easily as and when required. Moreover, there is no limit on the availability of funds to make your switches but in case of ULIPs, there is a defined kitty or basket of funds in which you can do your switches.

Investment Objective

Anoop Pabby, MD & CEO, DHFL Pramerica Life Insurance said that life Insurance products are bought with a long-term financial objective in mind, hence its’ always suggested to continue with your investments to meet these objectives without any compromise.

However, in case of any financial exigencies, the customer can withdraw from the policy. A ULIP has a minimum lock-in period of 5 years during which the customer doesn’t have access to his money, further in case of surrender the benefit is payable only on completion of 5 year lock-in period. The penalty in case of surrender varies from Rs. 6,000 in year 1 to Rs. 2,000 in year 4, there is no surrender penalty from the 5th year onwards. “For a long-term wealth creation, it is advisable that Policyholder should remain invested for the entire duration of the policy. Even in case of financial emergency, ULIPs provides a flexibility to withdraw an amount from their fund value after completion of lock-in period,” he said.

While in case of equity mutual fund there is no as such penalty is charged. However, if you redeem your money within a year you will be charged 15% short-term capital gain tax on your gains and if you redeem after 12 months you will be charged 10% Long-term capital gains tax if your gains exceed Rs 1 lakh. However, if gains do not exceed Rs 1 lakhs the all the money when realised is totally tax-free.

Scalable Comparison

Bhatnagar said that the 2009 ULIP reforms notwithstanding, the combined value of these costs can still easily cannibalise your annualised returns by anything from 3% to 4.5%. Over the long term, this seemingly small annual difference can severely impinge upon your wealth creation.

Besides, top performing mutual funds have consistently outperformed similar category ULIP’s over the medium to long-term, and this only stands to widen the performance gap between the two strategies.

“Smart investors should aim to unbundle their insurance and investment requirements and avoid ULIP’s – instead choosing to combine a term plan with a high claim settlement ratio, with a portfolio of top performing mutual funds. The most optimal solution would be a ‘smart’ term plan solution that dynamically resets the quantum of one’s death benefit in sync with one’s shortfall from their goal target amounts while redirecting the remaining money to higher growth Mutual Funds,” added Bhatnagar

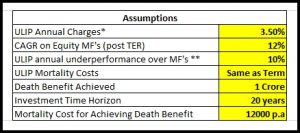

Having said that Bhatnagar explained the comparison between Mutual fund plus Term insurance and ULIPS through a set of a comparative example:

*Policy Administration, Premium Allocation, Fund Management

** Assuming 100% equity allocation in ULIPs# Death Benefit is considered same for ULIPs and Term insurance

Conclusion

Merely comparing products and investing will not help you achieve your financial goals. You should always make the investment as per your needs and wants. It is always suggested to draw a proper financial plan and make investment accordingly taking the help of a financial adviser.