All in all, one can expect a war-like situation like this emerging again in the future as well. It reminds us of the necessity of savings for the future or a rainy day.

The coronavirus pandemic has taught us many financial lessons – good and bad, welcomed and unwelcomed. But this one takes the cake. Saving for a rainy day is no longer enough. One needs to save for uncertain times like the pandemic as well. So start early by saving more.

During the lockdown days, I made friends with a few people whom I would like to introduce to you. Not just to introduce, but mostly to share their financial situation after pandemic induced lockdown.

Gautam is a 35-year-old software engineer and lives in a swanky rented apartment along with his wife, daughter and parents. He takes home a salary of Rs 1 lakh per month and is lucky to be associated with a company that cares for its employees. Even during the lockdown, he got his salary in full and more importantly on time. Thanks to the lockdown he could make some extra savings since the usual parties and family get-togethers and outings were out of question. He also availed the moratorium announced by the Reserve Bank of India on his credit card payment and vehicle EMI as he wanted to stay in cash till the uncertainty gets over.

However, now Gautam is little bit worried about the future on hearing companies layoffs, employees being furloughed or asked to take deep salary cuts in an arpeggio of simultaneous Zoom calls lasting just a few minutes each in his industry pours in. Gautam who never bothered to save or invest, now curses himself for being a bit spendthrift.

Another acquaintance was Hyder, who owns a hotel in his bustling neighbourhood. Since the onset of the lockdown, the revenue from the business has come to a trickle since he has to turn his establishment into a takeaway counter to follow the lockdown norms. Like Gautam, he also availed the moratorium on paying his housing mortgage EMIs from the bank. With profit coming to a trickle, Hyder has so far managed to make both end meets by dipping into his savings account. However, with business showing no signs of pick, he is turning jittery about how to pay his staff and the very future of his business.

And here is Kumar who is a wage labourer and earns his living by doing odd jobs. He is not able to find any work these days due to lockdown. Luckily the 5-member family managed to go without starving for couple of weeks since they got the provision kit supplied by the government. Kumar is now at his wits end as he scours the neighbourhood looking for odd jobs. He is not sure when he could resume his normal life.

These real-life stories depict the situation of many people I have come across during the COVID-19 pandemic so far. Other than those who bothered to save and invest, the story of the majority of households is similar to that of Gautam, Hyder and Kumar. So, where did they go wrong? It is crucial for everyone to do a soul searching about why they find it extremely challenging to lead a normal life in these unprecedented times.

Uncontrolled spending by stable income households and the inability to save a part of the earnings for meeting emergencies and exigencies by wage earners are the major factors that led to such a predicament. It also brings to fore a pertinent question: how to manage essential expenses during retirement period for salaried class, not to mention those who do not have any stable income.

Also Read: Car Insurance: Now pay as you drive – Check details

In this context, the impact of inflation on daily expenses should be considered. For example, households which usually spend Rs 25,000 per month for expenditure will have to spend Rs 31,907 after five years if the inflation rate is at 5 percent and Rs 40,722 after a period of ten years. This is because price rise or inflation dents the purchasing power of the rupee while increasing the cost of living considerably. This underlines the necessity for saving either in big amount or small amount by everyone to secure their life in the future. They should decide the amount of savings depending on their liquidity risk.

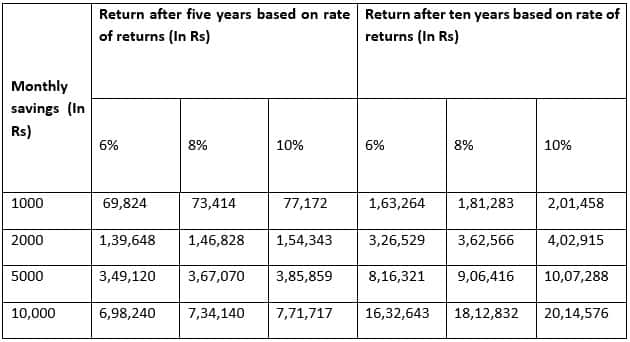

The below tables give the details on the return on investment ranging from Rs 1,000 by lower income group to Rs 10,000 by higher income group for varied period of time at specified rate of returns.

All in all, one can expect a war-like situation like this emerging again in the future as well. It reminds us of the necessity of savings for the future or a rainy day. This is the key financial lesson we should take away from COVID-19 pandemic.