One needs to remember that currency movements can partially impact the returns that investors make, and are not the only factor.

A common question that we come across when we meet NRIs across the globe is – “I have some money to invest in India. Let me know what’s a good time to remit the same, so we can then start investing or top up our portfolios?”

Depending on which part of the world the NRI investor comes from, we also see a certain target value for the rupee that they have in their mind against their home currency and they decide to either move monies into India, or remit it back to their overseas country of residence basis that target number.

A large portion of this obsession with the rupee value comes from the fact that the value of the rupee from the time that they moved from India to their current country of residence is much lower in most cases. Coupled with the volatility of the Indian rupee, there is therefore a keen desire to get the timing on the value of the rupee right.

For example, over the last couple of decades, rupee has depreciated by approximately 3.5% p.a. against the US dollar. However, depending on when different NRIs have started investing, their personal experiences on their own portfolio may be different as there have been times when this depreciation has been higher.

For example, an NRI investor who invested in 2007 may find that the rupee has depreciated by approximately 5% per annum in the last twelve years. However, the absolute amount changes tend magnify this depreciation, with the rupee valued at approximately 42 to the US dollar in 2007 and approximately 70 to the US dollar now. It is, therefore, critical for NRIs to look at the annualised fall in the rupee, rather than just the absolute changes in value.

In order to better understand whether trying to time the value of the rupee is likely to work for NRIs, it is important to first understand the drivers for the rupee appreciation/depreciation.

These drivers include the global prices of oil and therefore current account deficits in India, inflation differentials between India and the currency under discussion, liquidity flows, interest rate direction, global strength/weakness trends of the US dollar, amongst multiple other factors.

Considering the number of factors that influence the direction of the rupee movement, even central banks, with all their access to data and analytics, tend to find it very difficult to get the movement on currency right. For individual investors, to get this right, it is therefore even more challenging.

One needs to remember that the direction of the currency over long periods of time tends to be relatively easier, as compared to short-term directions. Thus trying to build the longer-term changes in currency value into your investment strategy is probably a far more robust strategy. One also needs to remember that currency movements can partially impact the returns that investors make, and are not the only factor.

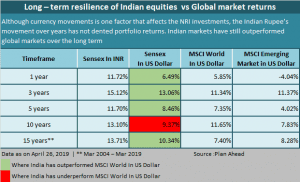

For example, investors in Indian equities in rupee terms have definitely had a better outcome than investors who look at Sensex returns in USD terms. However, when compared to alternatives like the MSCI World Index which is a barometer for global equity market performances, or the MSCI Emerging Market Index, which accounts for all emerging markets, the BSE Sensex returns in USD terms are better than those provided by both world indices as well as emerging market indices for most time frames, as can be seen in the table below.

NRIs would, therefore, have been better off having a portion of their wealth in Indian equities in spite of the currency depreciation.

It is, therefore, critical to focus on the underlying asset performance rather than just the value of the rupee when you make investment choices. Considering that most investors already understand that timing equity markets can be very difficult, it is equally important for NRIs to accept that timing the rupee is also very difficult, and thus their investment strategy should be focussed on trying to invest regularly, to get the benefit of averaging.

At times of extreme optimism or pessimism, there may be an added opportunity to take tactical calls on the currency to enhance returns. However, those opportunities tend to be few and far between.