OMCs are Bharat Petroleum Corp. Ltd, Hindustan Petroleum Corp. Ltd and Indian Oil Corp. Ltd

In 2020, a recovery in refining margins and crude oil price movement will be the key factors to monitor

Oil companies are unlikely to report big positive surprises when they announce their December quarter (Q3) results. During the quarter, average crude oil prices fell year-on-year and remained flattish sequentially. Accordingly, investors can expect price realizations of state-run producers Oil and Natural Gas Corp. Ltd and Oil India Ltd to reflect similar trends as seen in the oil prices.

Investors will watch production numbers closely when Q3 numbers are announced, especially for Oil India where production was hampered in December due to the protests over the Citizenship Amendment Act .

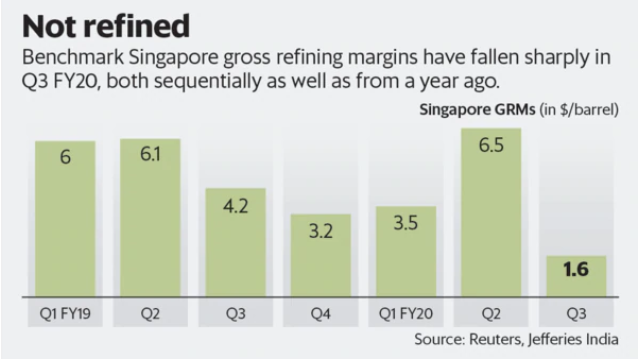

Meanwhile, the operating environment for refining companies in Q3 was gloomy, what with the benchmark Singapore gross refining margins (GRMs) declining sharply year-on-year (62% down) and sequentially (75% down).

The collapse in Singapore GRMs was primarily because of the miserable performance of fuel oil (FO) spreads. However, things may not turn out as bad for Indian oil refining firms as there are some comforting elements, which may indeed lead to a mixed set of numbers.

“Margins for the oil marketing companies (OMCs) will hold up better due to their lower FO exposure and inventory gains too will help amid steady marketing margins,” wrote analysts at Jefferies India Pvt. Ltd in a report on 10 January.

OMCs are Bharat Petroleum Corp. Ltd, Hindustan Petroleum Corp. Ltd and Indian Oil Corp. Ltd. Some analysts expect Hindustan Petroleum’s refining margin performance to be a tad weaker than it peers, owing to the higher share of FO in its product slate.

Analysts expect Reliance Industries Ltd’s (RIL’s) Q3 GRM to be in the range of $9-10.5 a barrel. In the September quarter, its GRM stood at $9.4 a barrel.

According to Jefferies India’s analysts, RIL’s refining segment may improve, but not as much as the Street had expected due to the International Maritime Organization’s new norms, while the petrochemical segment may post lower margins. Jefferies India has penciled in RIL’s GRM at $9.8 a barrel for Q3.

But for RIL, in keeping with the trend of last few quarters, its consumer businesses, telecom (Reliance Jio) and retail are expected to compensate for the muted performance of its energy business. “Retail and Jio should continue to see quarter-on-quarter improvement, though the full impact of tariff hikes is likely to come through over 4QFY20-1QFY21,” wrote JP Morgan India Pvt. Ltd analysts in a report on 8 January.

In 2020, a recovery in refining margins and crude oil price movement will be the key factors to monitor.