Of the total dues, the consortium of 17 banks led by SBI have so far recovered around Rs 400 crore, barely five percent the total outstanding

After waiting for close to eight years, lenders may finally have a way of recovering dues of up to Rs 9,000 crore from absconding businessman Vijay Mallya.

While the bankers Moneycontrol spoke to continued to be suspicious of Mallya, given the “complicated promises” he has made previously, their renewed hopes hinge on legal backing and the Fugitive Economic Offenders Bill, which is in the works and could fasten recovery.

Two years after his move to London, where he is now based, Mallya broke his silence on Tuesday. He made a public statement about his willingness to repay the loans he had taken from banks.

“The last time he (Mallya) offered to pay (in 2016) up was a conditional OTS (one-time settlement) offer which was on the condition of the Karnataka High Court’s judgment. Why should we settle for less when he is enjoying with the huge assets he has. We want to recover entirely…Now, with the courts leading the battle and that government wants to make an example of him, we should recover,” a senior State Bank of India (SBI) executive said.

Mallya has defaulted on loans (declared non-performing assets or NPAs since 2011) taken for his company Kingfisher Airlines, which has been grounded since 2012.

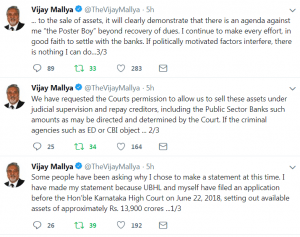

In his statement, the fugitive liquor baron said he and United Breweries Holdings (UBHL) filed an application before the Karnataka High Court on June 22, 2018, seeking permission to sell assets worth nearly Rs 13,900 crore and repay creditors.

Of the total dues, the consortium of 17 banks led by SBI have recovered around Rs 400 crore, barely five percent the total outstanding. Bankers are also trying to recover their dues from his overseas assets.

In 2016, SBI had said the Kingfisher Airlines’ loan was stymied by the legal process, with the bank having to face 180 adjournments and 500 hearings across courts and tribunals.

Poster boy

“I have become the ‘Poster Boy’ of bank default and a lightning rod of public anger…The CBI and ED moving aggressively to recover bank loans is unprecedented, despite my best intentions to settle with the banks,” Mallya said.

Hitting back at Mallya, a senior official of a large public sector bank that is a part of the consortium, said: “His offer was very complicated then and we only stood to lose. We can accept only if we get entire money back…It must be a direct settlement if he wants to indeed repay.”

Mallya, 62, is fighting several lawsuits in the UK and India over fraud and money-laundering charges.

The statement comes a few days after the Enforcement Directorate filed an application to declare him a “fugitive offender” and to confiscate all his assets, worth around Rs 12,500 crore.

Facing public ire for his flamboyant lifestyle, Mallya called himself a victim and wrote the letters to the Prime Minister and Finance Minister to “put things in the right perspective”.

“Fearing the legalities and the “fugitive offender” tag, he is under pressure. And why not, it is public money which he took on loan that he has to return,” another bank official said.