To our salaried customers, we give home loan sanctions within four hours, said Ambuj Chandna, Senior Executive Vice President and Head – Consumer Assets of Kotak Mahindra Bank

In the financial year ended 2018-19, Kotak Mahindra Bank disbursed 25 percent more home loans and loan against property than the previous year. Similarly, growth in credit cards and loans for small businesses was 32 percent.

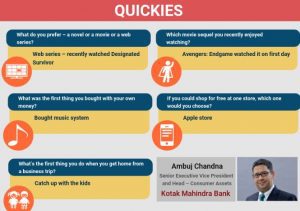

Ambuj Chandna, Senior Executive Vice President and Head – Consumer Assets of Kotak Mahindra Bank expects to see steady heightened customer demand in consumption-driven lending. In conversation with Moneycontrol, he talks about their lending strategy, instant loans, competition from non-banking financial companies (NBFCs) and fintech lending players, USP of their credit cards and more.

Q: Briefly give an overview of your loan book (with break-ups in each segment). What is your banks gross and net NPAs in last financial year and expectations going further? What measures you are taking for a speedy recovery of NPAs?

A: The loan book for Kotak Mahindra Bank is Rs 2.05 lakh crore as on financial year ended 2018-19. The breakup is broadly corporate banking accounts for 30 percent (Rs 61,000 crore), home loans and loans against property at 20 percent (Rs 40,700 crore), personal loan, credit cards and lending to small business loan segments at 16 percent (Rs 33,160 crore), agriculture at 13 percent and commercial vehicle (CV) and construction equipment (CE) segments at 10 percent.

Our gross non-performing asset (NPA) is at 2.14 percent as on March 31, 2019 against 2.22 percent in the previous year. Our net NPA has also improved to 0.75 percent as on against 0.98 percent in the previous year. We believe our NPAs are very much in control and don’t expect significant movement in either direction. Our strength lies in our robust underwriting skills and process. We have a stable outlook on NPAs for the current financial year.

Q: What is your lending strategy while disbursing loans to consumers for buying homes?

A: For home loans, our core focus is to reduce the processing time of the application. Recently we have launched a couple of initiatives for our home loan borrowers i.e. for our salaried customers, we give home loan sanctions within four hours. Looking ahead, we are investing heavily in technology for a decisioning online platform, which shall shorten the processing time even further for home loan customers.

For self-employed customers, the home loan process is not as simple as it is for salaried customers. Over time, we have invested in technology and have partnered with key fintech players in the industry. We are working on a digital and paperless loan approval process for self-employed customers be it for a business loan, loan against property, working capital finance loan or a home loan for a businessman, where we can evaluate the data, use that for loan decisioning and revert with loan approvals within 24 to 48 hours for self-employed customers.

We have competitive interest rates across our products and our ability to do fast decisioning on loan approvals leads to our growth in this segment.

Q: Despite 50 bps cut by RBI, most banks have only cut the marginal cost of lending rate (MCLR) by only by 5-10 bps. Discuss key reasons why banks are not passing on the rate reduction to borrowers?

A: MCLR is a function of the cost of funds in the marketplace i.e. cost of borrowing, liquidity in the system and demand-supply factors. Lending rates are also a function of the underlying risk involved. Transmission of interest rates by banks, both on deposits and loans, does take place in a sustained manner. We have been passing on the rate cut benefit to our customers in a structured way.

Q: While shifting existing home loan to a new lender what are the key parameters borrower needs to consider?

A: If a financial institution is offering very low interest rates on a loan than what your own bank is charging, then check how sustainable the new rate is. We firmly believe that a borrower must check the track record of the financial institution with the large banks, the process is very structured and very fair and that’s in favour of the borrowers. You may get 10-20 bps advantage today by shifting the existing loan to a new lender, but you may be taking a risk of an arbitrary increase tomorrow. Customers must be cautious of this.

Q: Are you facing competition from NBFCs and fintech that offer instant personal/consumer finance loans at attractive interest rates?

A: Since banks have a large deposit book, our cost of funds is typically much lower than it is for NBFCs and fintechs. This allows us to price ourselves much better than NBFCs and fintech players. Even in terms of ease, we have invested in technology to be able to give our customers convenience and quick processing of loans.

Q: In the credit card market, where do you stand and what’s your market share? What features of your credit cards make a huge draw?

A: We have a market share of close to 6 percent, which is increasing every year. Today, our growth in credit card spends is two times the rest of the industry. So, we are growing significantly faster than the rest of the industry. The key reason for this is, we have a good suite of products.

We have segmented the market, based on the requirements and needs of the customers with attractive offerings. We have a card which is designed for movie buffs. On this card, we give two movie tickets free every month to our customers. We also have a separate card that is designed for people who want value in terms of dining and entertainment. So, this card has a 10 percent cashback on dining and entertainment. In addition, there is a separate card that gives 10 percent savings on the purchase of groceries through online/retail partners. We also have a credit card designed for frequent travellers with several benefits attached to it.

Q: These days the banks have reduced forex mark-ups on credit cards to compete with forex travel card. Your views whether credit card or forex card is the best companion while traveling abroad for foreign transactions? Reasons.

A: Both are powerful products for customers and both these products serve different needs. The key benefit with the forex card is that you can lock in the forex rate while loading the foreign currency on the card. While, when a customer spends using a credit card, the transaction takes place on the forex price of that day.

Usually, say for a 2-week international tour, the cost will usually average out, so it is not that one is better than the other. Credit cards and debit cards are more flexible compared to a forex card since you don’t need to apply for a card just before travelling and there is no need to load any forex currency. So it is simple. Just swipe the same card with the same PIN while travelling abroad. Also, we offer preferential pricing in forex (conversion) rate on some of our credit cards.